After studying online trading on forex, stocks, or any other trading markets, it is a good idea to test your newly acquired skills. Demo trading offers real-time trading opportunities except for the funds on your trading account are fake. You can open a trade, set a stop loss, and take profit and trade like it was a real market. Demo trading is a must when new to forex or any other online trading industry. But you have to transfer to a real account at some point in time. In this article, we will discuss all the prerequisites before the demo trader is ready to go for real trading.

Demo vs Real trading, what’s the difference?

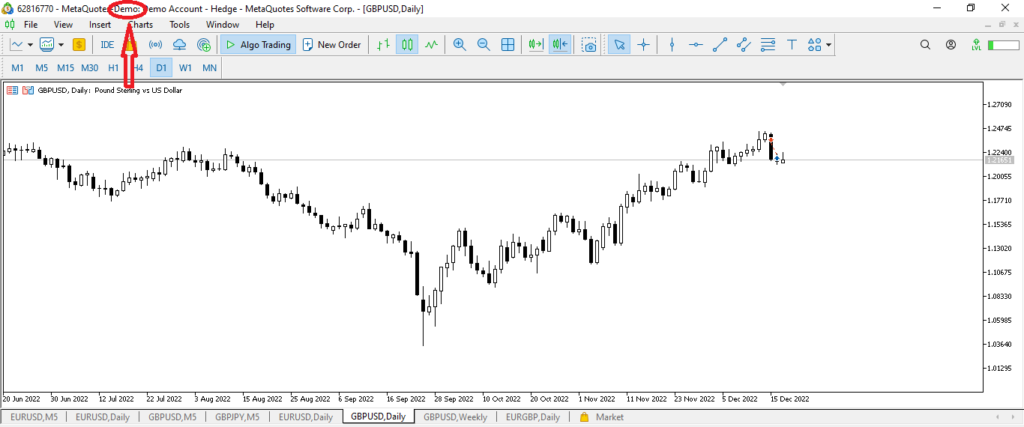

First, let’s discuss the differences between Demo and a real account. The only visual difference you can find between a demo and a real account is the word “demo” in the left-above corner in MetaTrader 5. This is similar to almost any trading platform.

It is important for a demo trader to read these guides to understand what trading is all about. As we have described, the difference between a demo and a real account is only the funds you are trading with, and it is a great tool to test your skills. But demo trading can cause emotional disconnection from your trading. Since funds are virtual there is little or no emotional side after losing virtual money, on the live account the stakes are real, and when it’s your real money at stake it is hard to maintain emotional intelligence. To negate this issue, the first step is to trade on a demo like it was a real account. This will help to negate emotional differences and prepare you for real trading. You should try to take part in trading competitions! This is very helpful to elevate your trading to higher levels without risking real funds. It trains your mind and discipline and definitely improves trading skills.

Before going real make sure you have:

- Well-tested trading strategy that generates profits consistently on a demo account. Make sure to trade on a demo account with your strategy after backtesting it. You don’t want to go to a live account and test strategy there. It is painful, trust me. Forex is no place to gamble, it is a business and a profitable one when done correctly.

- Discipline and emotional intelligence. You have to execute your strategy flawlessly and without error. This is very important. You should be able to follow your strategy even after it loses 2-3 times in a row. Sometimes market conditions aren’t perfect for your strategy and it may generate losses, but this doesn’t mean it isn’t profitable in the long run. So if the strategy is well-tested and you have winners in the long term, don’t throw it away only because it lost a few trades. Every strategy and every professional trader loses some trades, that’s a cost of doing trading business. Trading like any other business or profession has its costs and it is when the winning strategy loses money shortly. But it is hard to execute a strategy without errors when you lose your 2nd or 3rd trade in a row. Here comes emotional intelligence. Emotional intelligence is key in trading, it helps you stay put after losing money. It helps you remain calm and don’t make any decisions on an emotional basis. If you can master emotional intelligence, success is just a byproduct in any field.

- Controlling emotions and acting cool is necessary but what about real underlying risks when trading online? Well-established risk management strategy is another keystone in forex and stock trading. Make sure you understand trading-related financial risks and study ways to negate them. Risk management is key in any profitable business including forex, crypto, stock, etc trading.you can not risk too much for each trade, this should be included in your trading strategy and you have to develop and use it in any trading, demo, or live. Adjust risk management methods to reflect your risk tolerance and try not to risk too much even if you are risk-taking.

- Position sizing. When new to live trading make sure you start with the smallest lot sizes possible. You should try not to get emotionally hit when trading and as time passes it’ll be easier to trade on a live account with higher lots. This makes sure you transition from demo to live trading seamlessly and don’t make any psychological barriers while trading.

After going on a live account and trading don’t stop using the demo account. There are always new strategies you want to test and see how they behave. A demo account when used properly is a great aid for any beginner trader.