PipFarm is a young Forex proprietary trading firm that offers trading on large funded accounts for competitive one-time fees and a 25% discount on the first purchase, further reducing start-up costs for prop traders. The profit share is 90%, allowing traders to get 90% of their profits, which is very attractive in the industry. Here is how the PipFarm model works: The trader pays the corresponding fee on the funded account, starts an evaluation challenge, and shows the trading performance while operating within specific risk parameters. If a trader is successful at hitting a 12% profit target without losing more than 8% overall and 4% on any single day, they are granted the ability to trade on the funded account and withdraw profits. The key advantage of PipFarm is it offers only a few rules to follow and allows traders to access trading capital from 10k to 200k USD with a scaling plan of up to 500,000 USD. Trading on a 100,000 USD account enables PipFarm prop traders to make a good profit if they are successful. Let’s review PipFarm and evaluate whether you can trust this firm.

PipFarm prop trading firm background

PipFarm is operated by ECI Ventures Pte. Ltd and was established recently, making it a young but promising prop trading firm because of several factors. The most obvious one is its lack of complicated rules and limits. This indicates the firm is focused on attracting profitable traders, which is always a good sign. Another one is its super positive trader feedback on Trustpilot, with a high score. With these positive factors, there are also some drawbacks related to PipFarm with the most obvious one being the firm is very young and has little to no online reviews and trader feedback other than Trustpilot. However, the firm offers trading services through its regulated partner brokers, who are its main liquidity providers on the cTrader advanced platform.

Security of PipFarm Reviewed

The most important factor when evaluating prop firms is their security and reliability. Many frauds and scams are going on within the sector right now, making it even more essential to find reliable ones. PipFarm scam is highly unlikely, though, as the firm only offers several rules and has no hidden rules, indicating the firm’s focus on attracting successful trades and long-term relationships. PipFarm reviews are not yet opened on the FPA platform, which is understandable as the firm is still very young. However, PipFarm reviews on Trustpilot are positive, indicating the firm should be reliable for many of its traders. PipFarm prop trading services are offered by various regulated brokers, providing liquidity for the firm on the cTrader platform. Overall, PipFarm seems a promising young prop trading firm offering attractive conditions with 25% discounts on the first purchase.

PipFarm Trading rules analyzed

PipFarm rules are very forgiving and there are no hidden rules. Traders have to only follow several rules: not losing more than 4% of their balance in any single trading day, not losing more than 8% overall, and hitting the 12% profit target. News trading, overnight trading, and opening positions over the weekends are all allowed. Cryptos can be traded 24/7 and support is also available 24/7. High-frequency trading (HFT) robots and trade copiers are prohibited as they are difficult and costly to replicate. Other than that, traders are free to deploy any trading strategy they feel comfortable with.

PipFarm trading instruments explored

PipFarm allows its prop traders to speculate on a number of markets including Forex pairs, cryptos, metals, energies, and indices. The firm is not offering stock trading at this point. The instruments in each of the offered asset classes are 6 popular cryptos, 14 indices, 3 energies, 6 metals, and 10+ Forex pairs.

Spreads are between 0.1 and 0.2 pips and leverage is 1:30. There is a commission of 6 USD for FX pairs, which is understandable with spreads being this low. These specs are super attractive for scalpers who want to speculate on extremely short price movements. Although the broker restricts HFTs (high-frequency trading) robots, it is still allowed to use trading bots and all types of strategies, including scalping.

Fees at PipFarm

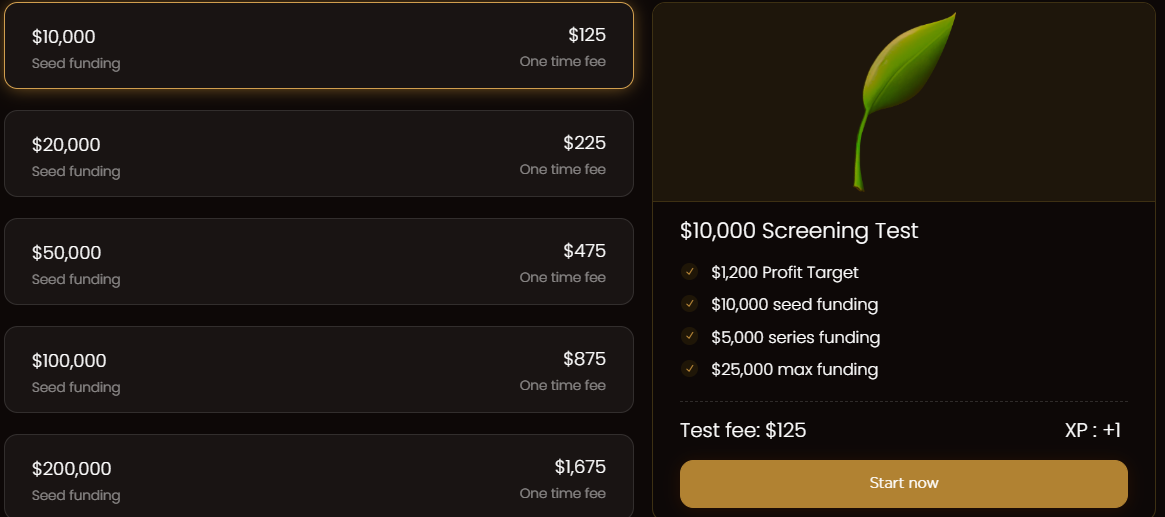

PipFarm fees are very competitive when compared to industry average numbers. The spreads are super low, the trading commission is average at 6 USD round turn, and with a 25% discount on your first purchase, the funded accounts also seem cheap. PipFarm prop firm offers a competitive fee structure for its funding options:

- 10,000 USD — 125 USD

- 20,000 USD — 225 USD

- 50,000 USD — 475 USD

- 100,000 USD — 875 USD

- 200,000 USD — 1675 USD

All these fees are one-time and enable traders to pay the fee and access large funding capital after passing the valuation phase. There is only one phase with all PipFarm challenges which is positive and enables traders to quickly become funded.

PipFarm Bonuses

PipFarm allows traders to get their first purchase with a 25% discount. This discount enables traders to start their prop trading career for just a fraction of the cost. For example, the 100,000 USD funded option becomes 656 USD, which is super competitive in the industry right now. There are no other bonuses ongoing as of now.

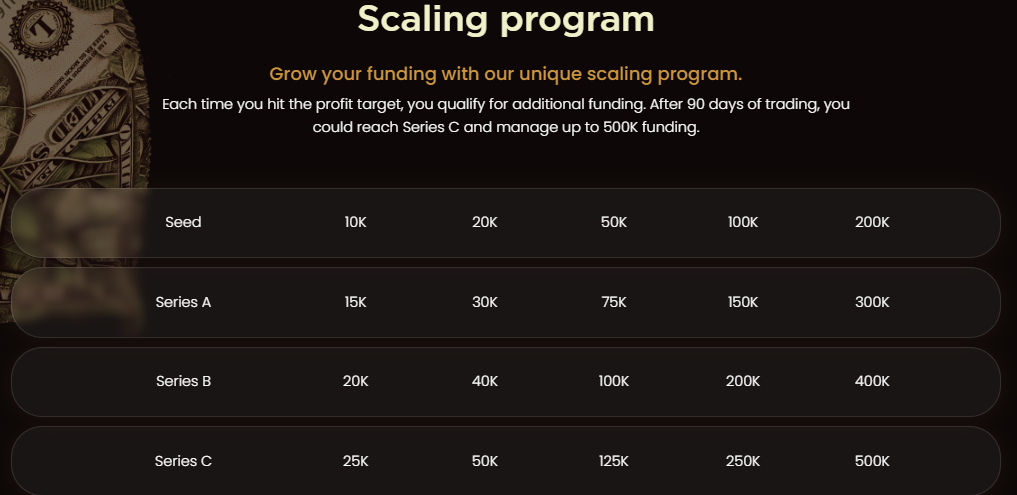

PipFarm Funded Accounts

PipFarm funding options are diverse and allow traders to select between 10k, 20k, 50k, 100k, and 200k USD accounts. While the maximum scaling ceiling is at 500,000 USD, it is only achievable if the trader starts on a 200k funded account. The PipFarm challenge offers traders a unique opportunity to show their performance and become funded. The scaling plan is activated every 30 days and requires a 12% profit target. This scaling plan apart from PipFarm’s seed funding options offers real value for traders who want to start small and increase their trading account size.

How to open an account at PipFarm

PipFarm offers a demo account which can be opened from the website. If you contact the support, they will also create a cTrader demo account for you to check the firm’s spreads and other conditions. To open a live account, select your seed funding amount, sign up, and pay the fee. Using a 25% discount code you can reduce the fee by 25% which is cool.

PipFarm deposits and withdrawals

Deposits and withdrawals are possible through several popular payment options, including both ban wire and online payments. The firm charges no fees itself, and traders can withdraw funds for 0 fees after they start making profits on the funded accounts.

PipFarm Trading Platforms

PipFarm cTrader is a good option for traders seeking advanced functionality together with inbuilt technical indicators, chart analysis tools, and even automated trading robots (cBots). The platform is similar to MT4 and MT5 and offers all the advanced capabilities any Forex trader will ever need.

Education and Support at PipFarm

PipFarm does not offer educational resources. However, there is a blog that offers limited educational resources and focuses more on the firm’s rules and products. So, the blog is not a replacement for educational resources. The firm focuses more on building an experienced trader base, which is also visible in its simple rules.

PipFarm customer support is diverse and offers several options such as live chat, Discord chat, and email support. Both the website and the support are only available in the English language as of now.

Final thoughts — Is PipFarm legit?

Pipfarm.com reviews are super positive on Trustpilot, indicating the firm is a young and legitimate prop trading firm. PipFarm funded programs are diverse and offer a good range of funding options from 10k to 200k with a scaling plan of up to 500k USD. PipFarm ratings are good on Trustpilot, caused by the few flexible rules and reliability of the firm.

Frequently Asked Questions

Is PipFarm a good prop firm?

The PipFarm scam is highly unlikely as the firm has a multitude of positive feedback on Trustpilot, has no hidden rules, and only requires several strict risk limits to follow.

Does PipFarm offer bonuses?

Yes, there is a 25% discount on the first purchase, allowing traders to buy funded challenge cheaper than nanny competitors.

What can I trade on PipFarm cTrader?

PipFarm allows traders to speculate on a range of markets including Forex pairs, cryptos, indices, and commodities.