HotForex is a famous Forex trading brokerage that sets itself apart by offering quite impressive trading terms and conditions. On the broker’s platform, you can trade an extensive array of instruments with large leverage and tight spreads.

HotForex is licensed by a number of high-tier financial regulators, including the one from the UK, UAE, and South Africa. It also features complex fund protection mechanisms, including negative balance protection and insurance of clients’ money.

In the following review of HotForex Forex broker, we will examine all of the important, as well as relatively insignificant features of the broker.

A quick backstory

As noted above, HotForex is a brokerage company that mainly offers currency pairs to its clients. The brokerage has two official names – HotForex and HF Markets – combined into one brand, HF Markets Group. It was established in 2010 in St. Vincent and the Grenadines.

In its decade-long operations, HotForex has received quite a few awards and prizes from prestigious ceremonies, including the Best Forex Customer Service Provider Latin America and more. But more importantly, the broker combines more than 2,000,000 live trading accounts and supports 27 different languages.

One of the things we wanted to check out was whether HotForex submits regular financial statements to its regulators. And we were able to find the documents that describe the company layout, disclose financial earnings, and provide the overall transparency of the company’s finances.

As the following HotForex broker review indicates, we’re dealing with a pretty high-end Forex broker that appreciates the value of financial regulation and transparency.

Safety of funds

The first important entry in our review is going to be the broker’s license. When you set out to find your perfect brokerage, you should always look at its regulatory materials first, because it doesn’t matter how impressive the trading offerings are – without a proper license, you are in danger of a scam.

As our reviewing team has discovered, HotForex features a pretty impressive package of licenses from different financial jurisdictions. Here’s the complete list of all licenses with some basic details:

St. Vincent and the Grenadines Financial Services Authority (SVGFSA)

The SVGFSA license turns out to be the main regulatory piece at HotForex because of a simple fact that the brokerage (HF Markets Ltd.) was established in this country under the registration number of 22747 IBC 2015.

Financial Conduct Authority (FCA) – The UK

The UK’s FCA license is undoubtedly the most sophisticated license we found during this review. The registration number of HF Markets (UK) Ltd. is 801701.

Dubai Financial Services Authority (DFSA)

Yet another license that HotForex owns under the name of HF Markets (DIFC) Ltd. The number of registration is F004885.

Financial Sector Conduct Authority (FSCA) – South Africa

Registered as HF Markets SA (PTY) Ltd, our HotForex review shows that this next license from South Africa allows the broker to operate across the whole African continent with pretty much no hardships. The registration number is 4632.

Financial Services Authority (FSA) – Seychelles

This FSA license comes from the Republic of Seychelles. HF Markets Ltd. was registered there under the number of SD015.

Fund protection mechanisms

When you look at the above-mentioned licenses, it’s not just about their multitude and complicated registration numbers; they actually make a difference for regular everyday traders. To prove that, here are some of the most high-end money protection methods that HotForex uses:

The first one is negative balance protection. When you enter any sort of financial market, the risk of losing money is always very high. Usually, when you lose, the money you’ve deposited to your account is being used to pay for the losses. However, sometimes your account runs out of money and you’re actually required to pay up for additional losses. With negative balance protection, HotForex helps you avoid that by automatically closing trades when you reach zero account balance.

Besides that, there are also other mechanisms, including fund insurance, segregation of funds, and many other risk management features. In short, you can be sure that the money you deposit at HotForex is in safe hands.

Which markets can you trade at HotForex?

Moving on, let’s take a closer look at which financial markets are available for you to trade at HotForex. As our HotForex Forex broker review shows, there are 6 different instruments that span across different markets:

- Forex pairs

- Commodities

- Indices

- Stocks

- Cryptocurrencies

- Bonds

As you can see, HotForex covers a large number of markets on its platform. And what’s more, these instruments come with quite impressive trading terms and conditions:

Currencies

Being the main trading instruments on the platform, there are 50 separate FX pairs from Major, Minor, and Exotic currencies. The maximum leverage for these instruments goes up to 1:1000, while spreads go as low as 0 pips.

Commodities

There are also 12 different commodities that combine Brent and Crude oil, natural gas, Coffee, etc. HotForex charges no explicit commissions for these instruments, the only fee being variable spreads that go as low as 0.008 pips.

There are also four precious metals at HotForex: Silver/Euro, Silver/US Dollar, Gold/Euro, Gold/US Dollar. These come with pretty much the same conditions as other commodities.

Indices

As for indices, we counted 23 assets that span from different markets and countries, including the US Dollar Index, US Wall Street, and EU STOXX 50.

Stocks

Next up, there are 56 different stocks available at HotForex for you to trade. These include shares of some of the largest companies, including the ones of Apple, Facebook, etc. As our HotForex review indicates, the commissions for these assets are fixed at 0.1% and spreads are also very shallow.

Cryptocurrencies

When it comes to cryptocurrencies, we were able to find 12 different symbols that have just recently been added to the platform. These include some of the most popular assets, including Bitcoin/USD, Litecoin/USD, etc. Commissions are fixed for crypto trades at $1 per round turn lot.

Government bonds

The last asset class at HotForex is bonds. This section includes 3 popular bonds: Euro Bund, UK Gilt, and US 10-year Treasury Note. In a sea of other and more volatile assets, these government bonds ensure that your portfolio can properly be diversified and safeguarded with more stable assets.

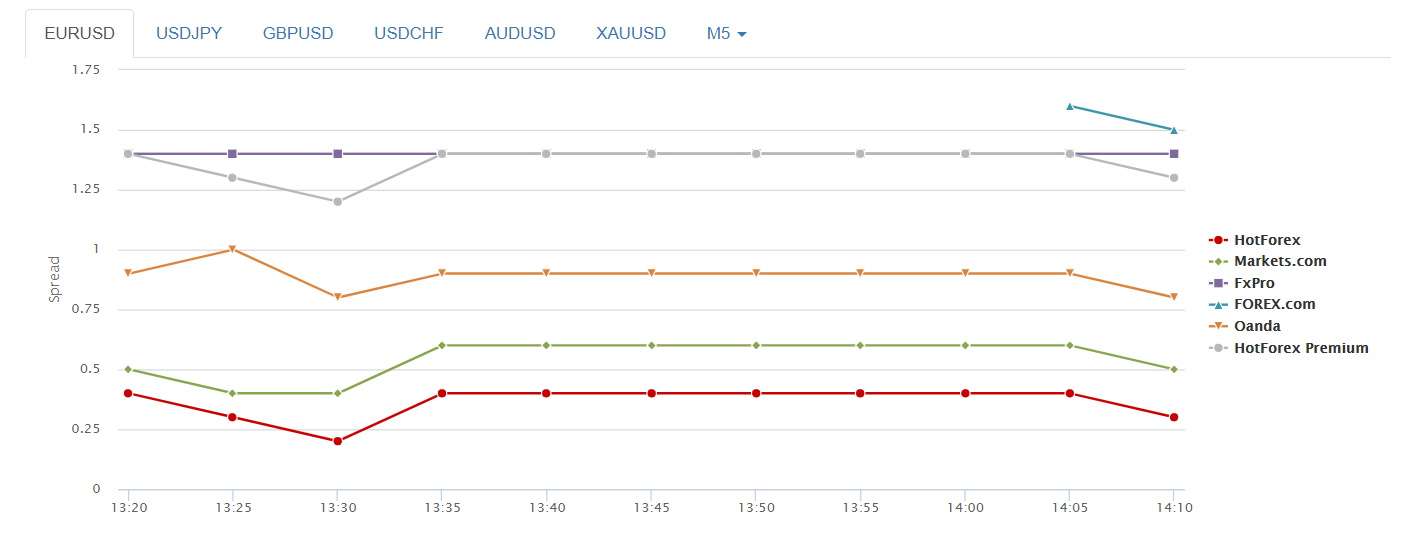

What are the commissions at HotForex?

The next important segment of our review is going to be HotForex’s commissions. As you saw in the previous section, the instruments available at HotForex come with quite impressive commission rates, often giving you a headstart over other traders.

We are going to separate this section into two categories: trading and non-trading fees. The first category will talk about account-specific commissions, as well as spread markups and overnight fees.

Trading commissions

As the following review of HotForex Forex broker shows, there are almost no commissions on the available account packages. The only exceptions here are:

- PAMM Premium Plus account – traders are charged $10 per round turn for all instruments;

- Zero Spread account – traders who exchange Major currencies pay $6 per round turn while for Minor and Exotic pairs, the round turn commission is set to $8.

Currency fees

As you can see, these two accounts have very specific use-cases, which is why HotForex charges a certain amount of commission for their use. Yet for other account types, there are no specific commissions other than bid/ask spreads that are charged well within the actual trades.

Depending on which account type you choose from, spreads will have different values. For instance, if you choose the Zero Spread account, you would pretty easily guess that the spreads would start from 0 pips. For all other accounts, spreads are also variable, yet they start from 1 pip.

Commodity fees

For commodities, there are no fixed commissions and the only fee traders will have to pay is spreads. These revolve around 0.01 to 11.4 pips and depend on the instrument that you choose to trade.

Stock and index fees

For stocks, you have to pay a 0.1% commission per round turn, as well as bid/ask spreads in-between 0.012-1.6 pips. For indices, the fixed commission is $1 and spreads range between 0.04-11.3 pips.

Cryptocurrency fees

According to our HotForex broker review, cryptocurrencies have some of the highest, as well as lowest, spread markups among all HotForex instruments. The maximum spread goes up to 30 pips, while the minimum goes down to 0.0006 pips. A fixed commission for crypto trades is $1 per round turn lot.

Bond fees

For bonds, the spreads are super-tight at 0.05-0.08 pips. And there are no other commissions for these instruments.

Rollover swaps

Yet another type of commission that you’ll be charged in certain conditions is a swap. Swaps activate when you decide to leave your positions open for a longer period of time than a single day. In that case, you’re either going to have to pay or get paid the interest rate difference between the asset that you have bought and the asset that you have sold.

The amount of swaps obviously depends on the type of the instrument, as well as the type of trade – whether it is long or short. Plus, if you roll over your trade from Wednesday to Thursday, swaps will triple in size.

One exception found during the following HotForex Forex broker review is that you can evade swaps by choosing an Islamic account. This is basically an identical account with the same offerings, with only one difference that it doesn’t feature interest rate markups – in accordance with Islamic law. But you have to prove that you really have the Muslim faith for that to happen.

Non-trading fees at HotForex

Moving on, let’s take a closer look at which non-trading fees and commissions you’re obliged to pay at HotForex and if there is a way to avoid them. One of the biggest advantages of HotForex is that the broker doesn’t impose any transaction commissions to its clients. What this means is that the amount of money you deposit or withdraw on/from your account will be exactly the same you’ll get.

And as if that’s not enough, the HotForex will actually refund any commission that your bank may charge you. But there’s a certain condition for that: the commission should be higher than $100. Nevertheless, this is a very beneficial condition that not a lot of Forex brokers offer.

Yet another non-trading commission found during the following review of HotForex Forex broker is the inactivity fee. Basically, if you leave your account inactive for 6 months – do not place any trade during that time, HotForex will charge you a mere $5 per month after that time. But it’s pretty easy to evade that commission: you just simply deactivate the account whenever you feel like you’re not up for trading and that’s it.

Are there any promotions you can get at HotForex?

After the review of HotForex’s commissions, we wanted to find out if there are specific bonus promotions that the broker offers. And hooray, we found some.

In the Bonus Offerings section, there are three separate bonus packages:

- 100% SuperCharged Bonus – Every time you deposit $250 or more, you get the ability to earn $2 cash rebates every single day. The maximum rebate amount is $8,000 and you can use that money in trades or you can withdraw it;

- 100% Credit Bonus – This is basically leverage that doubles your initial deposit. Besides, you get a more loose time limitation for completing the volume requirements imposed by the broker;

- 30% Rescue Bonus – Every time you make a deposit of over $50, you receive a bonus of $15 with a maximum cap of $7,000. One characteristic of this bonus is that it can only be traded, not withdrawn.

Besides these bonuses, there are also other promotions that we found during our in-depth HotForex broker review. These include loyalty programs, contests, and free funding. As you can see, even in promotions HotForex manages to maintain its high service standards.

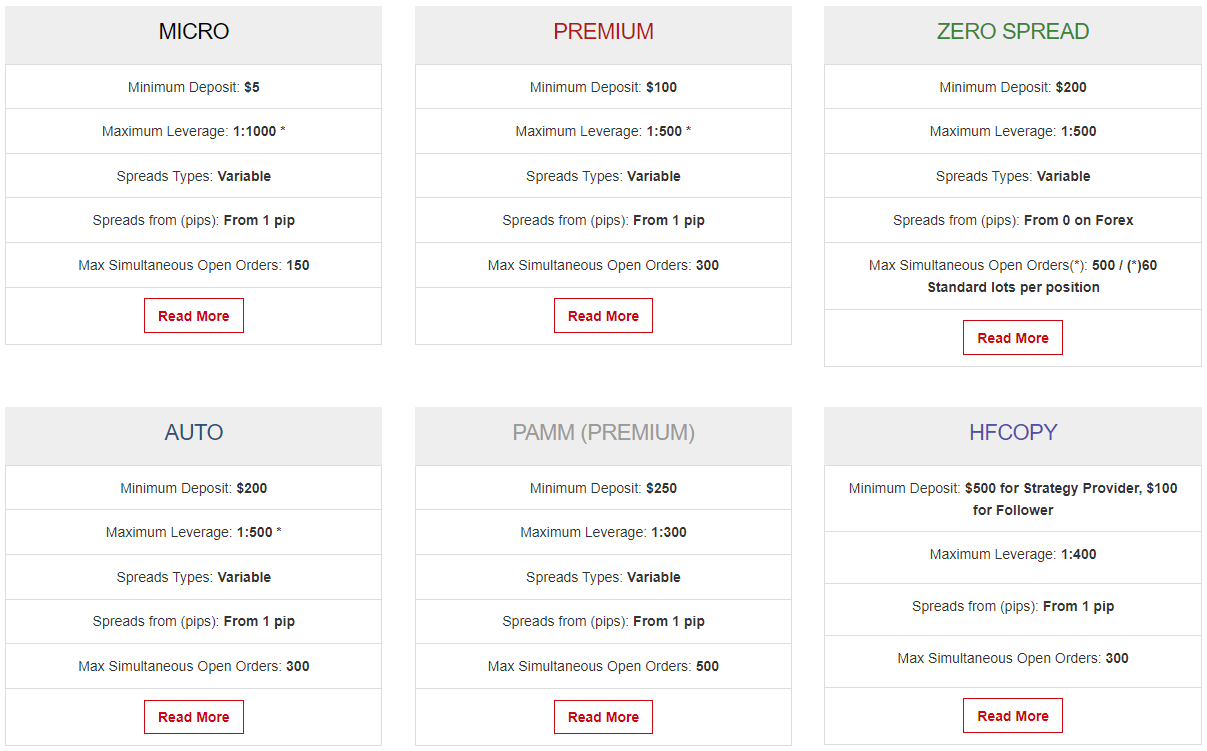

Account types offered by HotForex

After finding out the terms and conditions that drive the whole platform at HotForex, we decided to check out which trading accounts one can get by signing up with this broker. In total, we were able to find 6 live, one Islamic (that spreads across 4 live accounts), and one demo account.

Here are some of the most important details about the live accounts:

Micro account:

- Min. Deposit: $5

- Min. Spreads: Variable from 1 pip

- Commission: 0%

- Max. Leverage: 1:1000

- Tradable assets: All of them

- Execution Type: Market

- Automated Trading: Not supported

- Platforms: MT4, MT5, WebTrader, Mobile Trader

Premium account:

- Min. Deposit: $100

- Min. Spreads: Variable from 1 pip

- Commission: 0%

- Max. Leverage: 1:500

- Tradable assets: All of them

- Execution Type: Market

- Automated Trading: Not supported

- Platforms: MT4, MT5, WebTrader, Mobile Trader

Zero Spread account:

- Min. Deposit: $200

- Min. Spreads: Variable from 0 pip

- Commission: $6 on Majors, $8 on Minors/Exotics

- Max. Leverage: 1:500

- Tradable assets: All of them

- Execution Type: Market

- Automated Trading: Not supported

- Platforms: MT4, WebTrader, Mobile Trader

Auto account:

- Min. Deposit: $200

- Min. Spreads: Variable from 1 pip

- Commission: 0%

- Max. Leverage: 1:500

- Tradable assets: All of them

- Execution Type: Market

- Automated Trading: Supported

- Platforms: MT4, WebTrader, Mobile Trader

PAMM account:

- Min. Deposit: $250

- Min. Spreads: Variable from 1 pip

- Commission: $10 for all instruments

- Max. Leverage: 1:300

- Tradable assets: Forex, indices, commodities, shares

- Execution Type: Market

- Automated Trading: Not supported

- Platforms: MT4, WebTrader, Mobile Trader

HFCOPY account:

- Min. Deposit: $500/$100

- Min. Spreads: Variable from 1 pip

- Commission: 0%

- Max. Leverage: 1:400

- Tradable assets: Forex, Bitcoin, gold

- Execution Type: Market

- Automated Trading: Supported

- Platforms: MT4, WebTrader, Mobile Trader

Islamic account

As mentioned in this HotForex review, the broker also offers an Islamic account to its Muslim traders. It acts in accordance with Islamic law, which basically opposes the idea of an interest rate. So, if you sign up for the Islamic account, you won’t be charged with rollover fees.

Currently, you can open an Islamic account for the following four accounts:

- Micro account

- Premium account

- Auto account

- Zero Spread account

For each of these accounts, the trading terms and conditions are pretty much exactly the same, the only difference being the absence of an interest rate swap.

Demo account

Yet another important account that you need to know about is HotForex’s demo account. Right now, there are three different demo account types at HotForex:

- MT4 DemoHotForex

- MT4 DemoContest

- MT5 DemoHotForex

As you can see, demo trading is available for both MT4 and MT5. For regular demo accounts, the tradable account has a $100,000 virtual balance that refills regularly. For MT4 DemoContest, though, the virtual balance is locked at $10,000, which is still pretty high, and you can also take advantage of high leverage.

How do you open the HotForex account?

Now that we’ve discovered all of the available accounts at HotForex, as well as what features they offer, the next stop in our HotForex Forex broker review will be the exact process that you need to take to create these accounts.

As our team has discovered, creating an account at HotForex is a pretty simple and fast process. For that, you need a very basic set of personal details, including your full name, employment status, and ID documents.

Here’s the exact step-by-step description of the whole process after you’ve hit the Open Live Account button at the top-right corner of the screen:

- Put your full name, birth date, email address, etc; accept the privacy policy and solve a math problem;

- Verify your account using the link sent to your email address;

- Select your country and the address of residence, as well as your base currency;

- Disclose the employment status, annual income, and other KYC-related details;

- Upload a photocopy of your ID document and the proof of the billing address;

- Make a deposit to your newly-created account.

As you can see, there’s not an awful lot of details you need to provide to have a full-fledged live account at HotForex. The only documentation you need to upload is a color scan of your identification document (be it a passport, a government-issued ID card, or a driver’s license) and the scan of your billing address. As for the KYC details, you disclose your employment status, your annual income, estimated wealth, whether or not you are eligible for the US taxes, etc.

So, it’s pretty obvious from our review of HotForex Forex broker that the broker doesn’t distress you with burdensome requirements. And with just a few simple steps, your live trading account is pretty much set to go.

Which countries are supported by HotForex?

In this section, it is also important to point out the areas where HotForex is available for traders. As of right now, HotForex’s reach goes over 180 individual countries across the globe, which is pretty much all continents on Earth.

But there are some specific countries that are still beyond HotForex’s coverage area. These countries include:

- The United States

- Canada

- Sudan

- Syria

- North Korea

It is obviously a disadvantage for HotForex that it isn’t allowed to operate in these countries, however, it is important to note that they have some of the most stringent regulatory frameworks you can come across these days. The majority of Forex brokers cannot operate in these countries and we’re not surprised that HotForex cannot do that either.

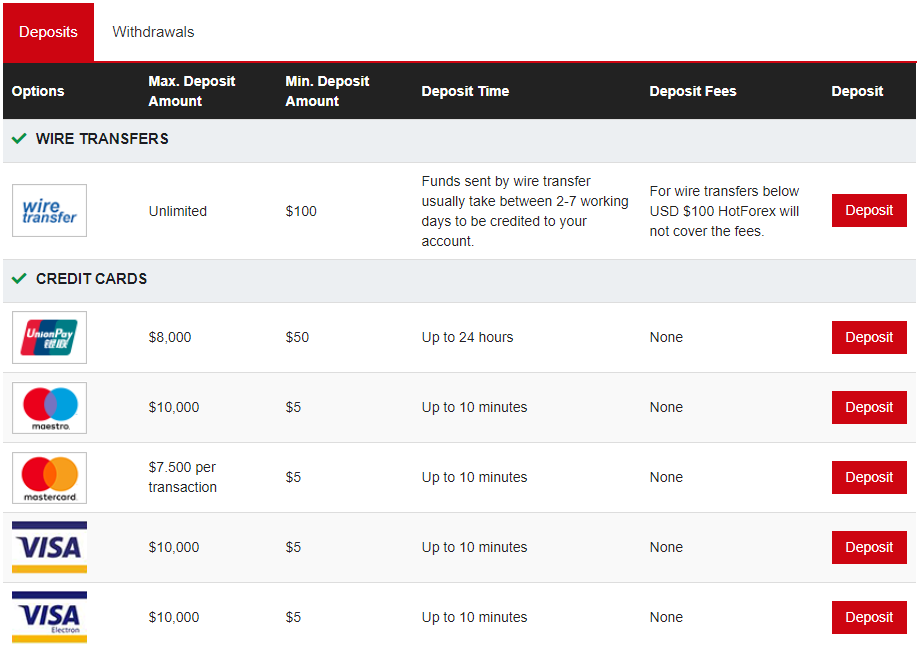

Deposits and withdrawals at HotForex

After you have created a live trading account at HotForex, the next step is to fund it. And as our HotForex broker review reveals, there are lots of different financial platforms for you to make a deposit, as well as withdrawal.

First off, the minimum deposit you need to make to your account depends on your account choice. It looks like this:

- Micro account – $5

- Premium account – $100

- Zero Spread account – $200

- Auto account – $200

- PAMM account – $250

- HFCOPY account – $500/$100

Having a $5 entry threshold is very beneficial for entry-level traders who want to start live trading without too much risk. And that is made possible by the fact that the minimum trade size is 0.01 lot (1,000 currency units), and the maximum leverage is 1:1000. This means that you can have a full-fledged trade with just a $1 deposit to your account.

Right, now let’s get to the payment methods and check out some of their most basic details. We’re going to list all of the methods in bullet points:

- Wire Transfer – Unlimited deposit; 2-7 business days; Withdrawal in 2-10 business days

- Union Pay – $8,000 max. deposit; Up to 24 hours; Withdrawal in 2-5 business days

- Maestro – $10,000 max. deposit; Up to 10 minutes; Withdrawal in 2-10 business days

- MasterCard – $7,500 max. deposit; Up to 10 minutes; Withdrawal in 2-10 business days

- Visa – $10,000 max. deposit; Up to 10 minutes; Withdrawal in 2-10 business days

- Visa Electron – $10,000 max. deposit; Up to 10 minutes; Withdrawal in 2-10 business days

- Bitcoin – $10,000 max. deposit; Up to 10 minutes; Withdrawals in 1-3 business days

- Bitcoin Cash – $10,000 max. deposit; Up to 10 minutes; No withdrawals

- Bitcoin by Skrill – $500 max. deposit; Up to 10 minutes; No withdrawals

- Other Cryptos – $10,000 max. deposit; Up to 10 minutes; Withdrawals in 24 hours

- FasaPay – $5,000 max. deposit; Instant; Withdrawals immediately

- Neteller – $50,000 max. deposit; Instant; Withdrawals immediately

- Skrill – $10,000 max. deposit; Instant; Withdrawals immediately

- VLoad – Variable max. deposit; Up to 10 minutes; Withdrawals before 10:00 on the same day

- WebMoney – $50,000 max. deposit; Instant; Withdrawals immediately

As you can see from this HotForex review, there are plenty of deposit and withdrawal platforms for you to use. And it’s also worth repeating that your payments are totally commission-free – you’re getting exactly the same amount of money that you have deposited/withdrawn.

Plus, some bank-related payments, that may be subject to intra-bank commissions, are going to be refunded by the broker if they exceed $100. HotForex constantly proves that it’s one of the most customer-oriented brokers you’ll ever see.

Which platforms power HotForex trading?

As we dug deeper into the broker’s website, we found that HotForex features some of the most sophisticated trading platforms on the market. This includes MetaTrader 4, MetaTrader 5 (for desktop, web, and mobile platforms), as well as HotForex’s own RapidTrader FIX/API platform, which we’ll take a look at at the end of this section.

So, here’s a quick rundown of all the important specs that the above-mentioned trading platforms have:

MetaTrader 4:

- Tradable assets: All 150+ of them

- Order types: 4

- Technical indicators: 30

- Automatic trading: Supported

- Copy-trading: Supported

- Desktop compatible: Yes

- Web compatible: Yes

- Mobile compatible: Yes

MetaTrader 5:

- Tradable assets: All 150+ of them

- Order types: 6

- Technical indicators: 80+

- Automatic trading: Supported

- Copy-trading: Not supported

- Desktop compatible: Yes

- Web compatible: Yes

- Mobile compatible: Yes

MT4 in detail

As you can see from this HotForex Forex broker review, these platforms are quite sophisticated in their offerings. MetaTrader 4 is arguably the most popular software for trading Forex, yet HotForex also allows you to trade all other instruments available on its platform.

One big advantage of MT4 over MT5 is that HotForex lets you use it for all live accounts. Plus, MT4 has a much larger user base and more pre-existing tools and scripts available online. With HotForex, you’re getting 30 different technical indicators, dozens of drawing objects, automated trading with Expert Advisors (EAs), and a community that delivers both free and paid signals right at your fingertips.

MT5 in detail

Moving on to MetaTrader 5, it is important to note that almost all features available on MT4 are also accessible on it, with one exception being the copy trading functionality.

And with such foundation, MT5 takes the trading experience at HotForex to the next level, adding further complexity to the platform. A brief list of the most important features of MT5 looks like this:

- 6 order types, including stop-loss, take-profit, etc.

- One-click trading

- 80+ indicators

- Complex chart view

- Additional chart time frames

- Hedging supported

- Economic calendar

HotForex RapidTrader FIX/API

As noted above in our review of HotForex Forex broker, there’s one additional proprietary platform called RapidTrader FIX/API that is far more advanced than the previous common platforms.

This is the software that requires HotForex clients to deposit no less than $200,000 to their accounts, whereas their withdrawals shouldn’t reduce the balance below that point. But why is that so? Why such a high threshold?

Well, according to HotForex, its RapidTrader FIX/API is an ideal platform for the highest-end traders, be they companies or individuals. With this software, the users can create more advanced orders, take advantage of automated quote engines and trading systems, and also use order-routing management systems. For regular traders, these terms might sound overly non-descriptive, but for professionals, they really make a huge difference in trading.

Trade with HotForex on your smartphone

One of the advantages of HotForex’s MT4 and MT5 is that they are both available for iOS and Android platforms. These are stock MetaQuotes applications that take advantage of all built-in features, which are further enhanced by the features added by HotForex. And you can pretty much do everything with these mobile apps that you would with their desktop counterparts.

Trade execution at HotForex

Another important entry in our HotForex broker review is going to be the execution policy on the platform. This will give us an idea about how fast the trades are executed, as well as some other features associated with the type of the platform.

As we have discovered, HotForex features a top-tier execution mechanism that ensures ultra-fast trades and convenient executions. The broker features both STP and ECN platforms. The STP platform means that HotForex takes your orders and directly delivers them to liquidity providers.

But when it comes to the ECN platform, things start to get more sophisticated. If you sign up for the Zero Spread account, you can get the ECN capabilities, which means you’re directly interacting with liquidity providers and HotForex doesn’t stand between you. What this also means is that the asset prices will be much more accurate and spreads will be much tighter, if not completely removed.

As for the execution type itself, all account packages support market execution, which is one of the fastest ways to open new trades. Besides, the prices will be quoted against direct market conditions without additional markups. And since there’s only the market execution, it means that HotForex will do no requotes – trades that the broker opens against its traders.

Another advantage found during this HotForex Forex broker review is that the spreads will be represented in the fifth decimal, which offers even more accurate pips. As for the maximum number of parallel trades, you’re able to run 500 different trades simultaneously, and each one can be 60 lots in size.

Getting more educated with HotForex

Now that we’re drawing near to the end of our review, let’s take a closer look at more optional features that nonetheless elevate the trading experience at HotForex. We will start off with education because as a licensed broker, HotForex has to have a top-tier educational section with sophisticated materials, and we want to check out whether that is the case or not.

Here’s are all of the available educational materials you can use at Hotforex.com:

Trading Academy

The first honorable mention in this list is definitely going to be the trading academy. With this extensive online course, you can cover all important aspects of online trading, including:

- The basics of Forex theory/practice

- Reading and interpreting charts

- Trading strategies

- The right trading psychology

- Technical analysis

What’s also very important is that you can access HotForex’s trading academy whether you’re a demo user or a retail customer.

Online Webinars

Another educational entry found during our HotForex review is live webinars. Financial experts at HotForex regularly conduct live conferences where they share their expertise with the novice Forex traders.

Educational Videos

Then there are lots of video tutorials available at HotForex that help you take your trading knowledge to the next level. With these interactive videos, you can get more insight into Forex trading terms, technical indicators, trading platforms, and even various market players. Additionally, we should also point out that these videos are uploaded to YouTube, which brings all beneficial features like streaming quality selection, playback speed, closed captions, and many more.

E-books

There are also various e-books that are offered alongside online courses. Therefore, the same topics such as Forex theory/practice, and many others are covered in these materials.

Term Glossary

Finally, there’s a huge glossary section that takes you through all of the important trading terms and phrases.

Research tools and features at HotForex

Yet another section we need to cover in the following HotForex broker review is its research tools and materials. With those at hand, you can really increase your trading effectiveness and profitability by predicting future price movements more or less accurately.

Here’s a quick look at all of the important research materials at HotForex:

Forex News

Trading Forex is closely associated with being in check with what’s going on in the global economy. This is the reason why HotForex delivers up-to-date Forex news from a trusted news-source called FXStreet.

Trading Ideas

As we have already mentioned above, HotForex features both paid and free trading ideas generated by professional Forex traders. These ideas are built into the MQL5 community and bolstered by the MetaTrader’s sophisticated platforms.

Technical Indicators and Signals

When it comes to technical indicators and technical analysis, there are over 50 different tools that you can use to predict the upcoming price swings and have more lucrative trades. There are also free trading signals that notify you whenever an important market development is taking place, so that you don’t miss a chance.

Autochartist

Next up, there’s an Autochartist tool that observes all of your Market Watch symbols, analyzes their price movements, and automatically alerts you when you need to enter the market.

Expert Analysis

Finally, there’s the expert analysis feature that pretty much explains itself: experts at HotForex provide their exclusive market development analysis and give you a better idea as to when it would be a good time to start trading.

How can you contact the broker?

The final section of this review of HotForex Forex broker is going to be customer support. As our team has discovered during the following review, there are a number of ways you can communicate with HotForex and get help from the support team, including:

- A live chat directly from the website

- Phone call: +44-2033185978

- Email support: [email protected]

Live Chat

Live chat is by far the fastest contacting method at HotForex. When we contacted the broker via this method, we received instant responses that helped us without any difficulty. Therefore, if you have a problem that needs the quickest response time, you should definitely use a live chat.

Phone Call

Next up, a phone call. When compared to the live chat, it might seem a little bit slow but it’s still one of the fastest contacting platforms at HotForex. In addition, there are diversified hotlines that work for different areas: there’s an international platform with numbers for China, Russia, Taiwan, and many other countries.

Email Support

As we have found out, email support is the most in-depth communication line at HotForex. It leverages the whole power of a professional support team and gives you the most thorough answers to your questions and requests. Plus, this HotForex Forex broker review also shows that there are different emails for different entities, including individual traders, affiliates, introducing brokers, etc.

What’s more, all of these support platforms are available on mobile devices as well. This means that wherever you go, you can trade with HotForex and get all the help from its support team.

Should you trade with HotForex – Our ultimate assessment

HotForex is one of the most well-established Forex brokerage companies on the market. In its decade-long existence, the broker has received quite a few prestigious awards, which in itself speaks a lot.

However, besides these awards, we have also found out that HotForex has more up its sleeve than just prestigious awards. For instance, there are many different tradable instruments available on the platform, including currencies, indices, cryptos, and many more. In total, you can trade 150+ separate assets.

And trading terms and conditions on these assets are also very lucrative. For example, the maximum leverage for Forex pairs goes up to 1:1000. HotForex also manages to eliminate all unnecessary commissions on its platform. It mainly depends on bid/ask spreads, and these are also pretty low, starting from 0 pip.

The following HotForex review has also shown that there is a large selection of educational materials, research tools and features, and trading platforms that you can get by registering at HotForex. For these and many more features we covered in our review, we can freely recommend HotForex to any of our readers.

Frequently Asked Questions

Can HotForex be trusted?

If you take a look at which regulatory institutions are monitoring HotForex’s financial activities, you would be convinced that this broker definitely is someone you can trust. Our HotForex review has shown that the broker has licenses from five different regulators:

- St. Vincent and the Grenadines Financial Services Authority (SVGFSA) – St. Vincent and the Grenadines

- Financial Conduct Authority (FCA) – United Kingdom

- Dubai Financial Services Authority (DFSA) – United Arab Emirates

- Financial Sector Conduct Authority (FSCA) – South Africa

- Financial Services Authority (FSA) – Seychelles

Now, just these licenses are enough to cement HotForex’s credibility. However, the addition of various money protection mechanisms, be it negative balance protection, fund insurance, or the segregation of accounts, makes your financial investment so much safer and more secure at HotForex.

Does HotForex offer bonuses?

Yes, there are three different promotion packages available at HotForex. These promotions include

- 100% SuperCharged Bonus – $2 daily cash rebates for deposits higher than $250;

- 100% Credit Bonus – leverage that doubles your initial deposit;

- 30% Rescue Bonus – for deposits over $50, you can get a $15 bonus that can max out at $7,000 in total.

What are the commission levels at HotForex?

When it comes to commissions, it is important to point out that HotForex manages to avoid the majority of unnecessary commission charges. This applies to account-maintenance fees (with a couple of exceptions) and payment commissions. In fact, if your transaction exceeds $100 and your bank still charges a commission, HotForex will refund it entirely. Having said that, there are spreads and overnight swaps that power the whole platform, and even these are very low, as low as 0 pip.

Which account types are available at HotForex?

With HotForex, you can create six different accounts, which have their specific minimum deposit requirements:

- Micro account – $5

- Premium account – $100

- Zero Spread account – $200

- Auto account – $200

- PAMM account – $250

- HFCOPY account – $500/$100

Each of these accounts works for different trader types. For instance, the Zero Spread account is great for high-end traders who want the lowest bid/ask spreads and highest returns. With the HFCOPY account, beginner traders can copy other people’s decisions and improve their perception of the entire trading process.

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK