Information flies so freely around our world these days, that even the distinction between news reports and social media rants has become blurred. This doesn’t mean we are equally informed, however, because it’s only when you have worked out a system to manage the information around you, that you can start to really internalize it.

This principle applies as much in the field of online financial trading as anywhere else. Certainly it’s a good start to read up and learn as much as you can, but you’ll also need to bow your head and take instruction from the professionals before you’re ready to take the reigns on your own. Only once you’ve trained your fingers to go through scales on your keyboard, can you start to turn yourself into a virtuoso pianist.

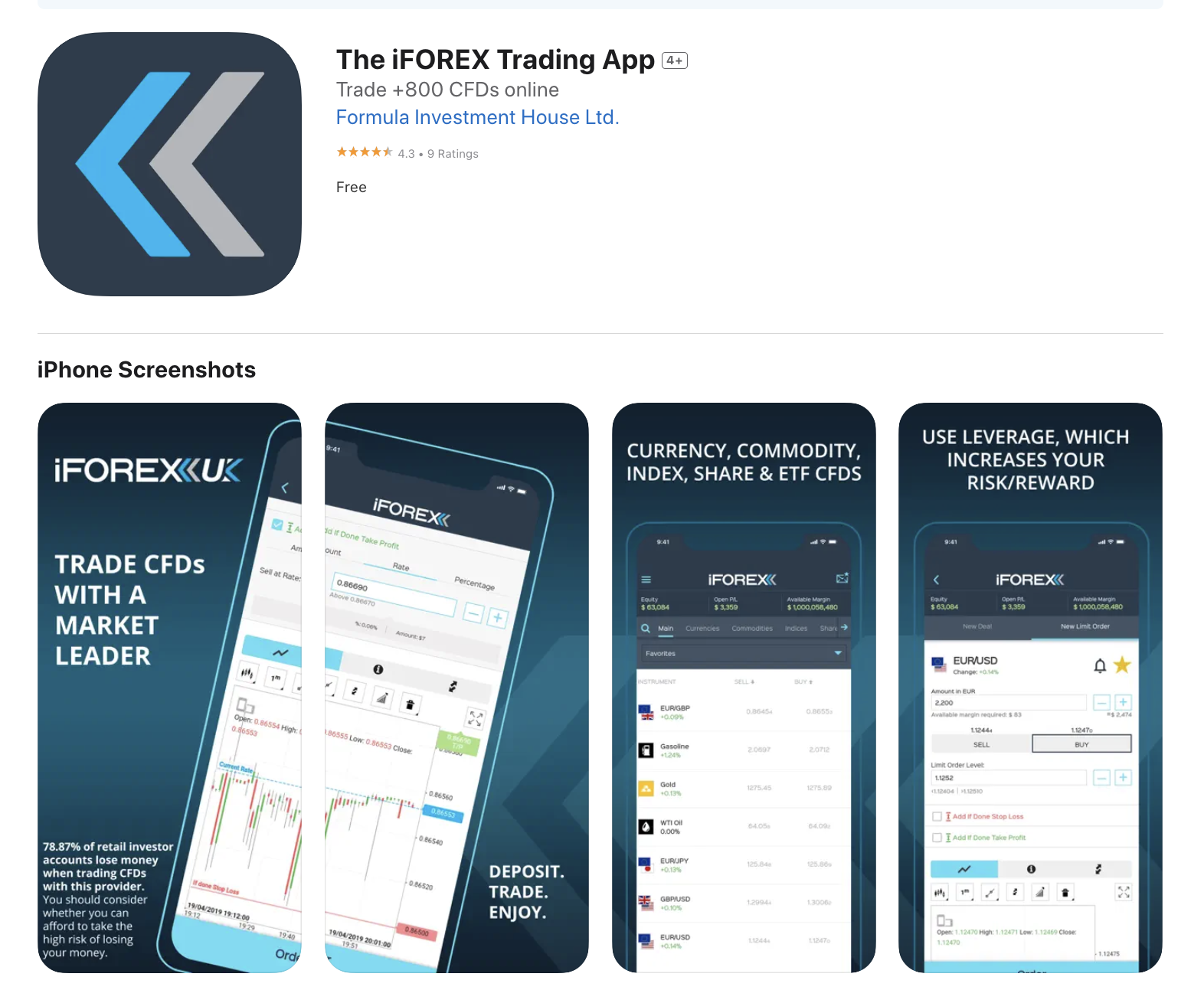

iFOREX Group know this, and that is why the array of over 750 CFD trading instruments available on their platform is not merely there in order to tempt. Rather, their extensive range is meant to be approached through the lens of their educational offerings. iFOREX is well-known for being an education-focused broker that pursues a course of building up their clients’ knowledge of the financial markets, even as they actively trade.

We will guide you on a brief tour through the aisles of iFOREX’s instruments. Firstly, though, we’ll say a few words about opening deals on iFOREX’s custom-made web platform, FXnet.

The FXnet Platform

The experience that’ll come your way when you open up the iFOREX app was carefully designed to suit you in every possible way. Only after the developers at iFOREX had digested every client comment, complaint, and suggestion, did they set about building a mobile app that embodies exactly what traders look for. The platform is made for you to customize to your own needs and preferences, and there are no tricks in operating its friendly interface. In short, it’s made to be used.

To open a deal, just pick your instrument; choose whether you want it to be a “buy” or “sell” deal; fix the size of the deal; and click “Deal”. That’s it.

Leverage

If you’re opening a buy deal on a currency pair like EUR/USD on the iFOREX platform, you can take advantage of leverage up to 30:1. This means that, in order to open a deal worth 30,000 euros, you need only pay out 1,000 euros and the remainder of the funds is lent you by your broker. The benefits you gain could be significant because, if your deal is a “buy” deal and the euro follows your prediction, appreciating in value by 2%, your gains will equal 2% of 30,000 euros (600 euros), rather than 2% of your 1,000 euro deposit (20 euros). The underside of leverage is that your losses also stand to be magnified, so, in our example, you would lose 600 euros if the euro dropped 2% against the dollar.

Stop-Loss Orders

When you’re setting up your CFD deal on the iFOREX platform, take advantage of the opportunity to set a stop-loss order. If you set the order 10% below the price at which you opened your “buy” deal on EUR/USD, then you can know that, in the event the euro depreciates against the dollar, (in defiance of your prediction), your deal will automatically close when prices drop by 10%. In this way, you have restricted the range of losses possible in your deal. Traders say that stop-loss orders also keep them focused on their plans and restrain them from making spontaneous and risky decisions.

The Instruments

Currencies available on the platform include both minor and major pairs, and feature such partners as EUR/GBP, GBP/JPY, and USD/CHF. Commodities you can trade as CFDs include cocoa, soybeans, natural gas, and many others. The extensive list of company shares on offer includes names like Anglo American, Bank of America, and Coca-Cola. If you prefer indices, you can choose among all the popular options like US 500, Germany 40, or US 30. The popular ETF market also has its place on the platform, so browse among big ETFs like Germany 40 Fund or China Top-50 Long *3. If you’re that way inclined, you could even choose to trade in the price movements of cryptocurrencies like Ripple, Litecoin, and Axie Infinity, whether those movements are up or down.

Wrapping Up

For the financial trader who is firmly rooted in a project of self-education, it’s always possible to learn about a new market and start trading in it. With the passing of time, your understanding of less familiar markets tends to grow, and you can quicken the process by actively reading up, more and more, on the industries you’re interested in. If you open a trading account with iFOREX, you can always know that a robust range of financial instruments stands ready for you, whenever the moment should arrive.