Selecting the right broker is a challenge every trader will face when starting the trading journey. Many brokers are decent and offer simple solutions and easy-to-use interfaces. TradeEU is one such broker. Although they are relatively new on the scene, they have already established themselves as a reliable partner for their users. We are going to go into detail and describe every important piece of information about TradeEU in this review.

TradeEU background

TradeEU is a trading name for Titanedge Securities Ltd. In 2021, the company got a brokerage license from the Cyprus Securities and Exchange Commission, better known as CySEC. TradeEU has offices in Cyprus and offers multi-language support via phone and email 24/5. Live chat is available only for specific account types, which we will describe below. All the information gathered indicates that TradeEU is a legitimate broker.

All legal documents are provided in PDF format and are available for download from the company’s webpage. Which adds to transparency and security.

Safety of your funds

After briefly explaining TradeEU origins and main characteristics, let’s speak more about their regulation and user protection.

Policies TradeEU follows

CySEC is a well-known regulator of the Forex market. They offer all the basic regulations which every broker should adhere to. They are also flexible and are not as overly restrictive as US regulatory bodies but always abide with ESMA rules. Furthermore, they allow hedging, which is a must-have tool for professional traders. Besides being regulated by CySEC, TradeEU’s clients’ funds are in segregated accounts and not in the company’s account. They are also part of the Investor Compensation Fund. All the mentioned documents are available on their website in the legal documentation section.

Available trading instruments on TradeEU

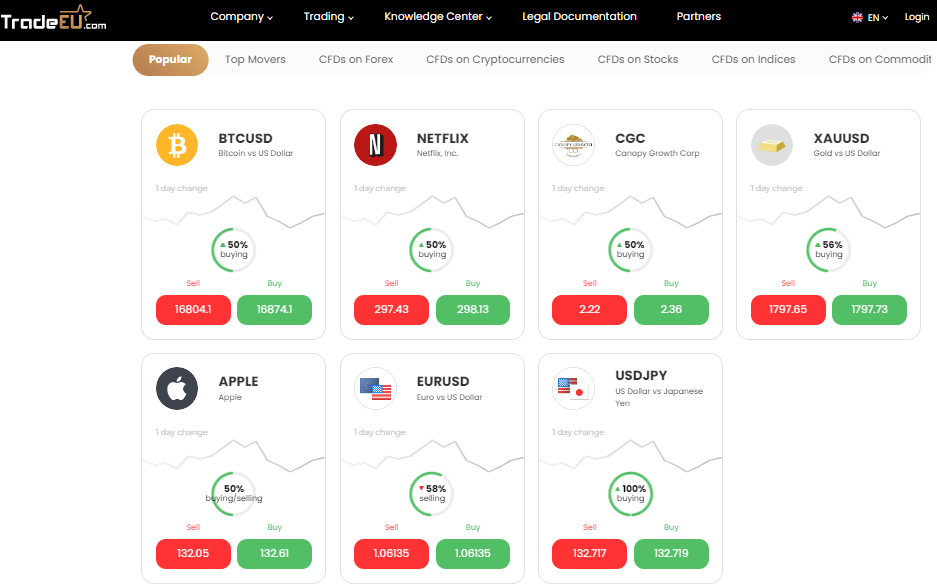

TradeEU is a Forex broker which offers CFDs for various assets including stocks, indices, cryptocurrencies, and commodities. There are 250+ trading assets available in total, which is a relatively low number as compared to other well-established brokers, but they are relatively young and will provide more in the future. Let’s consider each of them in detail.

- Forex – there are all major, popular, and some exotic trading pairs available on their MetaTrader 5 platform. Forex pairs availability paired with low spreads are essential when trading Forex online. The spreads are starting at 0.7 pips for the Platinum account. We will discuss TradeEU account types below. 0.7 pips can attract intraday traders and maybe scalpers as well. Leverage is 1:30 for retail clients, which is lower than many other brokers, but it has its advantages, mainly it reduces traders’ risk exposure and keeps their maximum possible losses in check. TradeEU offers negative balance protection, which is a very important piece of information. For accounts other than platinum, more long-term focus is recommended.

- Stock CFDs – stocks are very popular and essential must-have instruments in online trading, and it is necessary to be able to trade stocks on any forex broker platform. Trading stocks as CFDs comes with numerous benefits over trading physical stocks: CFDs are more liquid than real stocks and are preferred for speculating markets short and medium term. Traders can short CFDs right away, which makes it a useful instrument that could provide possible success in both bear and bull markets.

- Commodities – Commodities are grouped into two categories, soft and hard ones. Soft can be grown like cattle, corn, etc. Hard commodities are the ones that companies can mine, such as precious metals and energy. With TradeEU, you can trade CFDs on gold, silver, platinum, Brent and Crude oil, Natural gas, etc. Commodity prices change based on global demand and supply. This makes commodities attractive for fundamental traders.

- Indices – Indices offer a window to see a greater picture of markets. Not only are they usefulfor trading opportunities, they also enable traders to see the overall market tendencies. S&P 500, Nasdaq, and DJIA are among the most popular indices. Why search in other places when you can evaluate the whole market by just watching these important indicators? TradeEU offers major indices to its clients, that can be used as indicators or traded as CFDs.

- Precious metals – Gold, Silver, and Platinum trading become especially active during high inflation. TradeEU enables traders to access CFDs of various precious metals. Precious metals are viewed by some as a safe haven during economic crisis as investors drive the demand. High demand increases prices. It’s known that precious metals are a great hedging tool against inflation.

Account types, commissions, and fees

TradeEU requires no commissions for CFDs in Forex, Metals, Stocks, Energy, Commodities, or Indices. Swaps are constantly updated and provided on their website for each account type user. Since fees are different for each account type, let’s describe them here.

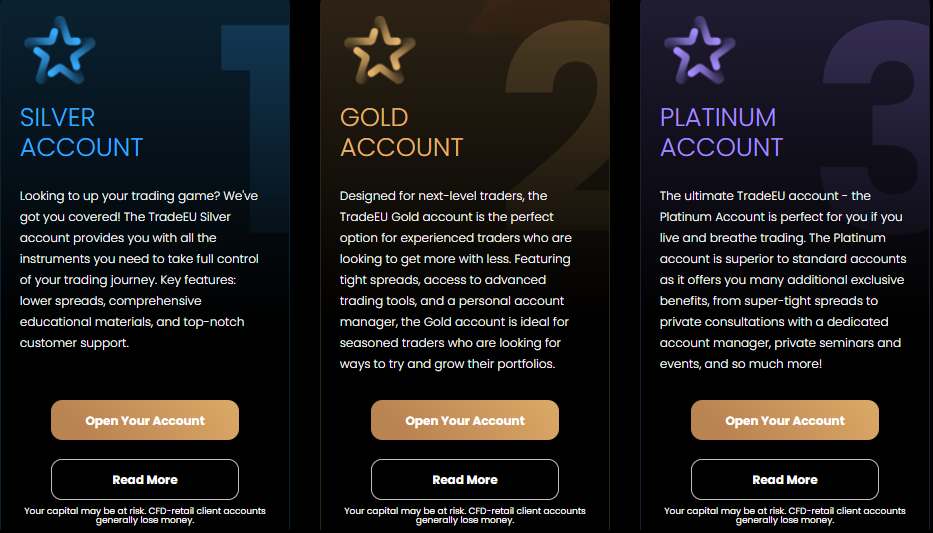

There are three main types of accounts offered by TradeEU brokers. Each of them has its advantages and disadvantages. Silver is the most basic account type, and it offers no live chat or account manager. The spreads start at 2.5 pips. The minimum lot size is 0.01 for all three accounts. Gold and Platinum accounts however are offering both live chat support and an account manager. Spreads are also different and lower, starting at 1.3 pips for Gold and 0.7 for Platinum accounts respectively.

Silver account:

- Min. deposit: 250 Euro.

- Min. spreads: variable from 2.5 pips.

- Commission: 0%.

- Max. leverage: 1:30.

- Tradable assets: all 250+.

- Execution type: Market.

- Hedging: supported

- Automated trading: supported.

- Live chat: Not supported.

- Personal account manager: not supported.

Gold account:

- Min. deposit: 250 Euro.

- Min. spreads: variable from 1.3 pips.

- Commission: 0%.

- Max. leverage: 1:30.

- Tradable assets: all 250+.

- Execution type: Market.

- Hedging: supported

- Automated trading: supported.

- Live chat: supported.

- Personal account manager: supported.

Platinum account:

- Min. deposit: 250 Euro.

- Min. spreads: variable from 0.7 pips.

- Commission: 0%.

- Max. leverage: 1:30.

- Tradable assets: all 250+.

- Execution type: Market.

- Hedging: supported

- Automated trading: supported.

- Live chat: supported.

- Personal account manager: supported.

Is TradeEU legit?

From all information and research we have conducted so far, TradeEU seems a legit Forex broker with a bright future ahead. They protect traders’ funds using segregated accounts. In addition, negative balance protection is available in case something goes wrong. TradeEU is regulated by CySEC and all legal documents are available for download in PDF format on their website. Furthermore, they operate in highly regulated European financial space and are focusing exclusively on European markets, which means they are not afraid to advertise their services and are sure in themselves. They offer many benefits to Gold and Platinum account holders. The broker is constantly working to improve their services. 30:1 leverage for retail clients makes sure that traders’ exposure to risks is as low and close to their capital as possible. This low leverage adds to TradeEU’s credibility. Clients’ fund safety and traders’ protection from overleveraged trading are a great upside for TradeEU clients. They even offer personal support and personal account manager to their Gold and Platinum clients.

For partners, they have flexible and comfortable programs. It is simple to partner with TradeEU, and they provide all the necessary tools for various purposes. They offer flexible debit/credit card and wire transfer deposits and withdrawals. The fact that they don’t use suspicious third-party payment systems associated with obscure entities is great news. Only focusing on essentials and delivering high-quality service and products are the main characteristics of TradeEU. They lack a bit on the educational side, though, but are offering analysis and educational materials for VIP clients.

Summary

In conclusion, TradeEU is a Forex and CFD broker offering its services mainly to European customers. TradeEU is regulated by CySEC. They offer currency pairs, commodities, indices, shares as CFDs and cryptos for trading. TradeEU has clients’ funds on segregated accounts and is part of the investor compensation fund. In addition, they also provide negative balance protection and 0% commissions. Spread markups depend on account type you choose. Generally, trading fees are low, and trading conditions are great.