When it comes to FX trading, prop trading has emerged as a popular method to pass the evaluation and get access to trading capital through funded accounts. However, the sector is plagued by inexperienced firms that do not deliver their promises and are often not focused on traders. FundedBull was launched by experts who have experience in the industry and is solely focused on delivering the best prop experience in the long run.

We have checked online sources and the firm has very positive trader feedback, which is one of the most critical parts of prop firm safety evaluation.

FundedBull offers advanced trading platforms provided by several liquidity providers and brokers, allowing the firm to offer the best pricing on spreads, reducing trading costs for traders. The broker also offers discounts of up to 20% allowing traders to further reduce the 49 USD price market for the 5k funded challenge.

Safety of FundedBull

The firm has very positive reviews online, which is crucial for indicating the safety of the firm. With traders evaluating the firm positively, the prop trading experience should be top-notch. The firm also offers access to various trading platforms such as DXTrade, MetaTrader 4, MetaTrader 5, cTrader, and Match-Trader offered by multiple brokers and liquidity providers. This creates a safe trading environment for traders, eliminating chances of price manipulation.

Overall, FundedBull seems a super reliable prop firm that focuses on traders and has already amassed positive feedback online.

The financial markets to trade at FundedBull

FundedBull allows traders to access a diverse range of markets including Forex pairs, indices, cryptos, metals, energies, and commodities. All these instruments are provided at low spreads and very low trading commissions, achieved by combining multiple liquidity providers into one pricing which automatically selects the lowest spreads.

The maximum leverage is capped at 1:50 which is more than enough to further increase the buying power of substantial trading capital, FundedBull traders have a luxury to access.

FundedBull Rules and Limitations

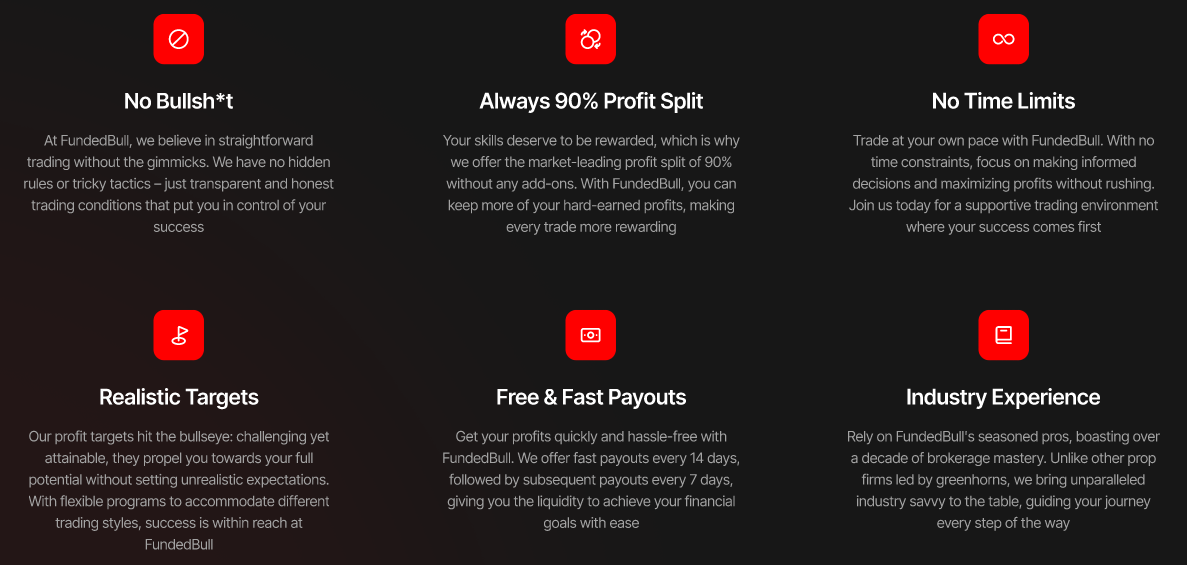

FundedBull has very competitive rules as it is focused on simplicity and long-term trader focus. The profit target is actually very low at 6% and traders can get funded after achieving just 6% of their account in profits. The overall drawdown varies depending on the account and is mostly at 6-8%. The daily risk limit also changes and is mostly at 4%. Traders have to trade for at least 5 days to get funded and there are no mandatory stop-loss rules, which is advantageous.

FundedBull Funded Accounts

FundedBull offers diverse funding options ranging from 5k to $250k. With these funding options, FundedBull is suitable for both beginners and experienced traders. With low entry barriers and low funded accounts, even beginners with low budgets can access funded challenges cheaply and try to get funded. The exact funding options from FundedBull include $5k, $10k, $25k, $50k, $100k, and $250k. These options are the same for all three funded account types, 1-step, 2-step, and 3-step. The 1-step account only requires traders to hit the profit target, and they are immediately eligible for a funded status which is super flexible, especially for experienced traders. 2-step and 3-step funded accounts are mostly for general funded trading and more suitable for beginner traders who want to slowly progress and become consistently profitable.

How big are the commissions at FundedBull

FundedBull offers super-low spreads and low trading costs to support all types of trading methods, including scalping. The funded options are also offered at very competitive pricing and are among the lowest in the industry.

The lowest $5,000 funded accounts start from $49 which can further be reduced by ongoing 20% discounts after providing the code which is given on the firm’s website. With these low fees, FundedBull has effectively eliminated entry barriers for novice traders, allowing them to cheaply start a prop trading career. A $5,000 account is more than enough for beginners, while the 250k accounts will be sufficient for professional traders.

As for the non-trading fees, the firm does not charge inactivity or any other fees. Withdrawals are also at $0.

FundedBull Trading Platforms

FundedBull excels in offering a diverse range of popular trading platforms including DXTrade, MetaTrader 4, MetaTrader 5, cTrader, and Match-Trader. These platforms are available for all devices including desktop and mobile devices and come also for web browsers. They allow traders to analyze the market comprehensively both technically and fundamentally with built-in plugins. There are very few prop firms that offer these many trading platforms, and FundedBull is definitely among the top firms with a number of available platforms.

FundedBull Education and Tools

FundedBull is a suitable prop firm for both novices and experienced traders and offers them both advanced educational resources and training courses. These materials are vital for novice prop traders to start their careers and achieve consistent profitability. The firm aids its traders with numerous tools to analyze trader’s performance and monitor their progress. These tools are available for both desktop and mobile.

FundedBull Support

FundedBull provides traders with multilingual support and a website around the clock, allowing international traders to access help at any time. Customer support is key for prop traders, especially beginners and FundedBull offers all the popular channels such as live chat, email, and hotline.

How to open an account at FundedBull?

To access diverse funding options and achieve funded status at FundedBull, traders have to click on the sign-up button. They will have to choose the account type, and funding options, and enter crucial details. After the account has been opened and the funded challenge purchased, traders will need to verify themselves by providing documents. Depending on the funded account type, they have to pass challenge phases and hit profit targets without breaching rules to achieve the funded status.