Contents

- 1 A brief background of the company

- 2 How safe are you with easyMarkets?

- 3 Financial instruments to trade at easyMarkets

- 4 How high are commission levels at easyMarkets?

- 5 Are you getting any bonuses with easyMarkets?

- 6 Account types to get at easyMarkets

- 7 How to open an easyMarkets account

- 8 Which trading platforms can you choose at easyMarkets?

- 9 Which payment methods to use for easyMarkets deposits and withdrawals?

- 10 Execution policy at easyMarkets

- 11 Get an education at easyMarkets’ learning section

- 12 Conducting research at easyMarkets

- 13 Customer support at easyMarkets

- 14 The ultimate verdict

- 15 Frequently Asked Questions

easyMarkets is a member of elite trading brokerages. It has been operating on the market for almost 20 years now, and in that time, the broker has garnered quite an acclaim: easyMarkets boasts with dozens of international awards, as well as with its sponsorship of a Spanish football club, Real Betis.

When you register at easyMarkets, you become a member of a trading platform that is strictly regulated by two of the most widely-known and powerful financial licenses in the industry: CySEC from Cyprus and ASIC from Australia. With these licenses come a bunch of money protection mechanisms, be it account segregation, negative balance protection, and many more.

There are, in total, over 200 different financial instruments you can trade at easyMarkets, and these are scattered in 6 separate categories, from FX currencies all the way to stocks and cryptocurrencies.

In this review of easyMarkets Forex broker, you will come along with us to take a closer look at every important detail about this broker. And by the end of it, you’ll have a better idea as to why easyMarkets is a great trading partner.

A brief background of the company

Before we go any further about discussing the broker’s trading offerings, we need to take a quick look at where easyMarkets comes from, as well as where it stands right now.

Everything started back in 2001 when the brokerage was founded. Back in the day, when trading was solely done in broker’s offices and only the most affluent traders could participate in it, easyMarkets started to democratize the whole industry. It allowed regular people to also trade and make money in various different markets.

With that inclusive attitude, easyMarkets has managed to turn into a truly global brokerage that serves hundreds of thousands of customers and counts over 2.5 trillion USD in traded volume so far. This, coupled with the fact that easyMarkets has been a recipient of 37 different international awards, and you get a broker that immediately radiates professionalism and trust.

As always, we tried to find any negative coverage about easyMarkets on the web. Yet despite our diligence, we weren’t able to find any, except for small-time scam reports that can be easily disproved. In short, our easyMarkets review shows that this is a broker that has no significant strain in its background, which is always an advantage in this field.

How safe are you with easyMarkets?

After the company background, it’s time to move to more significant aspects of our review, starting with easyMarkets’ regulation. With closer inspection of the broker’s licensing measures, we can easily find hidden and other details that don’t fit in the whole image.

With that said, we are pretty sure that there’s nothing of that sort to be found at easyMarkets. Here are the financial licenses that monitor the broker’s activities:

Cyprus Securities and Exchange Commission (CySEC)

The first main regulatory material we came across is from the Cyprus Securities and Exchange Commission (CySEC). Obtained in 2007 with a license number 079/07, the CySEC license definitely acts as a safeguarding mechanism for easyMarkets’ clients. Regardless of some suspicions about its credibility, the license is still part of the EU-based MiFID directive, which additionally enforces strict financial rules and guidelines.

Australian Securities and Investments Commission (ASIC)

The second license we found during our easyMarkets Forex broker review comes from the Australian Securities and Investments Commission (ASIC). And once again, we have no doubt that this license does a great job in monitoring the broker’s activities and making sure that its clients are safe. easyMarkets obtained this license two years after its establishment, back in 2003, with a registration number of 246566.

How is your money protected?

Besides licenses, it is also important to talk about the actual safety measures that help protect your money at easyMarkets. In fact, the above-mentioned licensing materials oblige the broker to have various protection mechanisms in the first place.

The first measure to talk about is negative balance protection. It activates when you start introducing the leverage into your trades. Now, when you apply a 1:100 or any other multiplication rate to your position, your incoming profits increase with the same rate. However, losses also become so much more hurtful to your account.

And when you keep on losing during leveraged trades, it is much easier to run out of the entire account balance and get into negative balance, which means you’re required to pay for the losses from your wallet. To prevent that, easyMarkets offers negative balance protection, which automatically closes your trade the moment it reaches 0.

Another safety measure found during our easyMarkets broker review is fund segregation. When you create an account at easyMarkets, your money isn’t going to be jam-packed with other people’s funds, least of all with the company’s finances. Instead, it’ll be safely kept on separate accounts, free of any risks of unexpected financial fluctuations. On top of that, easyMarkets cooperates with only the most top-tier global banks. This means that only the low-credit-risk banks are safe-keeping your funds.

On top of all that, easyMarkets constantly maintains an adequate level of liquid capital, which will be used in the case of financial crises to cover all deposits.

Financial instruments to trade at easyMarkets

The next important topic to discuss here is the financial instruments that you can trade at easyMarkets. As we have already mentioned in the introduction, the broker offers more than 200 different instruments, which are separated into six asset classes:

- Forex pairs

- Shares

- Cryptocurrencies

- Metals

- Commodities

- Indices

Currencies

As a Forex trading brokerage, easyMarkets primarily focuses on currency pairs on its platform. This is why we found over 60 different currencies on its platform, which include all classes, be it majors, minors, or exotics.

One of the biggest advantages found during our review of easyMarkets Forex broker is the trading terms and conditions that accompany these instruments. First of all, the maximum leverage that you can get for the currencies goes up to 1:400, which means you can potentially get x400 more profits from your trades. On top of that, spreads are fixed for all assets, meaning you’re getting the same bid/ask price difference, regardless of the current market conditions.

Shares

The next asset class to trade with easyMarkets is shares. It includes over 50 assets from some of the biggest companies, including Apple, Amazon, Facebook, Coca Cola, Tesla, and dozens more. Stocks, as well as other available assets, can be mainly traded as CFDs, although there are some particular instruments that can be traded as options or futures.

By trading shares at easyMarkets, you can a bunch of different features and advantageous conditions. For instance, the Inside Viewer mode lets you see what percentage of traders are actually trading the particular share that you’re interested in. Besides, there are usually no or very low fixed spreads for these assets, which is always a great advantage.

Cryptocurrencies

Another instrument type we came across during our easyMarkets review is cryptocurrencies. Granted, there are only three crypto pairs to choose from:

- BTC/USD (Bitcoin)

- XRP/USD (Ripple)

- ETH/USD (Ethereum)

it’s worth noting that the majority of crypto traders usually use these assets anyway. And despite the limited number, easyMarkets’ cryptocurrencies still have pretty decent conditions: 1:50 maximum leverage and spreads that go as low as 0.004 USD.

Metals

We were quite surprised to see that there are around 20 different metal instruments that you can trade at easyMarkets. These assets include Gold, Silver, Copper, Platinum, Palladium, and dozens more.

On top of that, you can also trade Gold and Silver as options, meaning you’ll only need to determine whether the price will increase or decrease, the rest will happen automatically. And when it comes to spreads, the minimum for the metals goes down to 45, while the maximum can easily reach 2,500.

Commodities

As for commodities, we counted 12 different resources to choose from. These include:

- WTI Crude Oil/Brent Oil

- Wheat

- Natural Gas

- Soybeans

- Sugar

- Coffee

- and more…

Spreads for these contracts can go as low as 3 pips, which is something that not many brokers can offer to their clients.

Indices

The final instrument class we found during our easyMarkets broker review was indices. There are, in total, 15 index instruments available on the platform, which include Dow Jones, S&P 500, NASDAQ tech, and many more.

Spreads for easyMarkets’ indices are also pretty low, going down to 0.5 pip. And you can usually trade them from Sunday night till Friday night, with some exceptions.

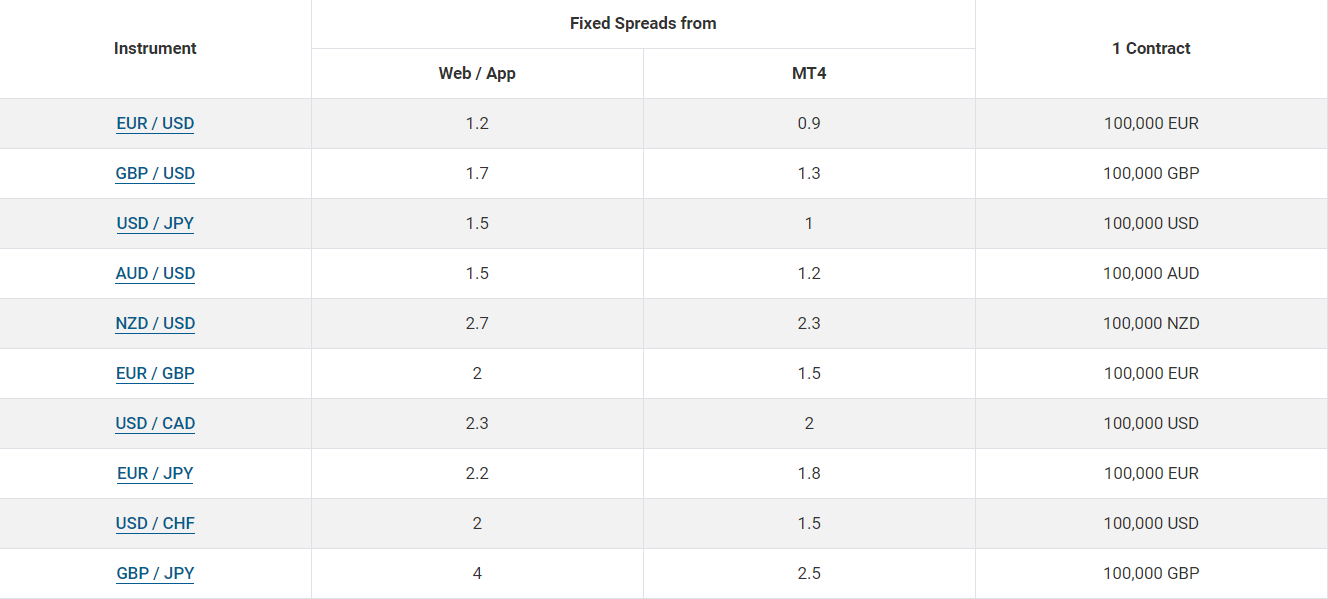

How high are commission levels at easyMarkets?

In the previous chapter, we have briefly covered spreads – the main commission charges at easyMarkets. In this chapter, we will take a much closer look at how high the commission levels are on this platform.

As always, there will be two sub-sections in this chapter: trade-related and non-trading commissions.

Trade-related fees

When looking through different sections of easyMarkets’ website, we have discovered that there aren’t too many commissions to pay here. For instance, the broker doesn’t charge separate commissions for creating/maintaining an account; neither does it have fees for separate instruments.

What this means is that the main source of income for easyMarkets is through spreads.

Currency fees

For currency pairs, spreads are quite low and competitive, compared to other brokers’ fees. As we have discovered, all spread charges are fixed and they vary from one instrument to another. For currencies, the minimum spread goes down to 0.9 pips, while the average revolves around 1-2 pips.

Share fees

With shares, you’re getting even tighter bid/ask spreads. Our easyMarkets Forex broker review shows that spreads for the shares can go as low as 0.02 pips with the usual spread at 0.3-0.5 pips.

Cryptocurrency fees

For three crypto-assets at easyMarkets, spreads can down to 0.004 USD (XRP/USD), yet the maximum price difference goes as high as 40 USD for Bitcoin.

Metal fees

Next up, let’s see how metals are charged. Spreads for these assets are still fixed and vary between 50-2,500 pips.

Commodity fees

Commodities have some of the lowest spreads at easyMarkets. We found out that the minimum spread goes down to 3 pips for oil, whereas the maximum can go up to 200 pips for Soybean.

Index fees

Finally, there are indices with even lower commissions than commodities. The minimum spread can go as low as 0.5 pips and the maximum goes as high as 25 pips.

Swaps for overnight trades

As a regular Forex trading broker, easyMarkets also charges swaps for overnight trades. These only occur if you decide to prolong your position for a longer time period than a single day. The difference in the interest rates of the two assets in your pair will determine, whether the swap is charged or credited by the broker; if the bought asset has a higher interest rate, then you get the swap credited to your account; if it’s lower, then you have to pay for it.

Now, during our review of easyMarkets Forex broker, we found out that the swaps for Wednesday-Thursday trades will triple in size to account for the inactive weekends. But it is incredibly easy to avoid rollover fees altogether by pursuing day trading.

Non-trading fees

When it comes to non-trading fees, our job is much simpler in the sense that there’s not much to talk about. As easyMarkets points it out, both deposits and withdrawals are completely free of charge, making it sure that you’re getting exactly as much as you’ve transacted.

But even more impressive than that is the fact that there’s not even an inactivity fee to pay here. The majority of brokers that we have reviewed are all charging dormant account fees, which usually activates after the 90 days of inactivity on your account. But with easyMarkets, you can have your account as long as you want; you can even leave it untouched for a long time and be sure that not a single penny will be charged to your account.

As you can see from our easyMarkets review, trading with this broker has no hidden strings attached. And the commissions that you’re required to pay are super-affordable, ensuring that you’re getting the most out of your successful trades.

Are you getting any bonuses with easyMarkets?

After reviewing financial instruments and their conditions, we went on to find whether easyMarkets offers any promotions to its clients. Granted, one cannot form an opinion about the broker’s credibility from its bonus offerings, it’s still nice to see some additional gifts and surprises on your account.

As we have found out, there are currently three different promotion plans that you can get with easyMarkets. These include:

- First Deposit Bonus – Make your very first deposit and get a bonus of 50% or up to $2,000 on your trading account;

- Partnership Programme – Become an affiliate partner of easyMarkets and get lucrative commissions from the broker;

- Refer a Friend – Have friends who also want to get into the world of trading? Refer them to easyMarkets and earn a buck or two – it’s as easy as that.

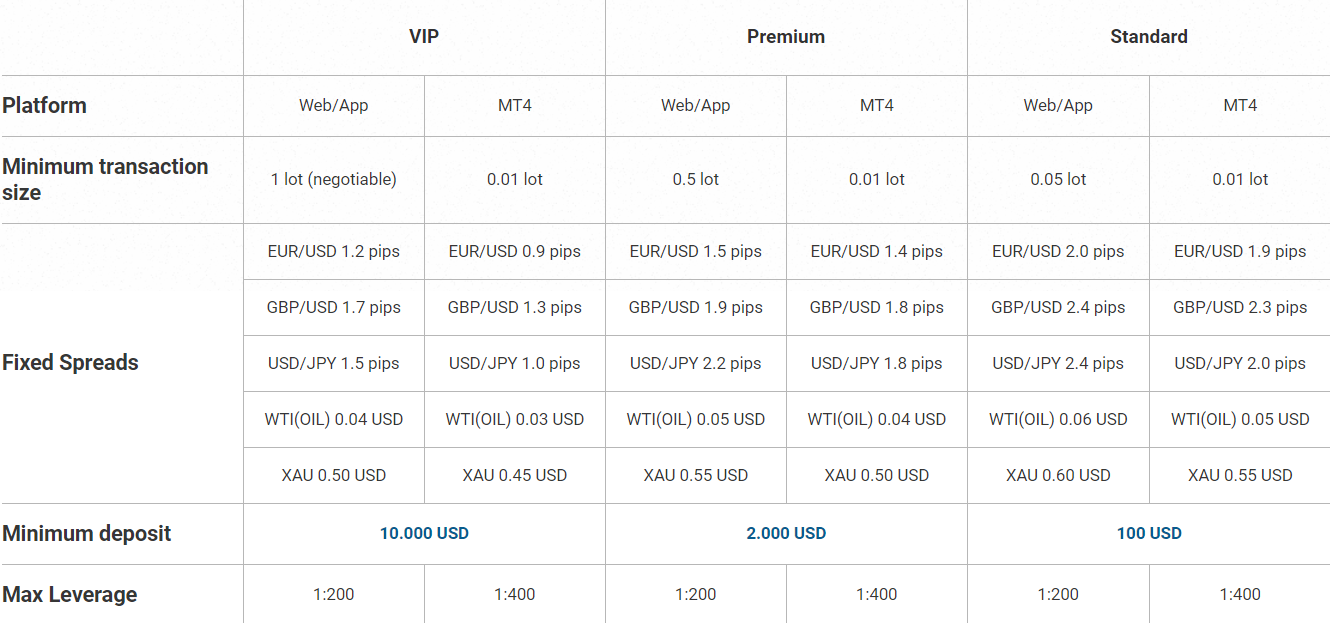

Account types to get at easyMarkets

As we have already seen in this review of easyMarkets Forex broker so far, the instruments and their conditions that are available on this platform are advantageous for virtually any financial trader. With that in mind, it is pretty reasonable to want to sign up at easyMarkets.

When it comes to the account types that you can get with this broker, we came across 3 retail accounts, as well as one demo and one Islamic account. Let’s have a closer look at how each of these accounts performs in real life:

Standard account:

- Min. Deposit: $100

- Min. Spreads: Fixed at 1.9/2.0 pips

- Commission: 0%

- Max. Leverage: 1:400/1:200

- Tradable assets: All 6 of them

- Execution Type: Market

- Automated Trading: Supported

- Platforms: MetaTrader 4, WebTrader, Mobile Trader

Premium account:

- Min. Deposit: $2,000

- Min. Spreads: Fixed at 1.4/1.5 pips

- Commission: 0%

- Max. Leverage: 1:400/1:200

- Tradable assets: All 6 of them

- Execution Type: Market

- Automated Trading: Supported

- Platforms: MetaTrader 4, WebTrader, Mobile Trader

VIP account:

- Min. Deposit: $10,000

- Min. Spreads: Fixed at 0.9/1.2 pips

- Commission: 0%

- Max. Leverage: 1:400/1:200

- Tradable assets: All 6 of them

- Execution Type: Market

- Automated Trading: Supported

- Platforms: MetaTrader 4, WebTrader, Mobile Trader

Islamic account

Besides the above-mentioned live trading accounts, we have also discovered an Islamic account during our easyMarkets Forex broker review. As noted earlier in the commissions section, the broker charges swaps for overnight trades, and since Muslim nations usually oppose any kind of interest rate, easyMarkets goes as far as to remove the swaps for its Muslim clients.

Demo account

Finally, easyMarkets also allows its clients to get a demo account and trade any available instrument virtually. Having a demo account is always a great advantage, especially for beginner traders who want to hone their skills without spending money. But it’s not only for beginners; even the experienced traders will find some use for this feature, be it for testing out a new strategy or changing the trading instrument.

When you get an easyMarkets’ demo account, the broker gives you a pre-loaded virtual balance of $10,000. And worry not: when you run out of that balance, it’ll automatically restore to let you trade without interruption.

How to open an easyMarkets account

Now, if you liked the available trading terms and conditions of easyMarkets and found its accounts appealing, there’s no reason why you shouldn’t register on this platform. And as our review shows, creating an account at easyMarkets is very simple and fast.

During our easyMarkets broker review, we decided to create the account on our own to find out just how easy it is to do that. And unsurprisingly, it was quite an easy process.

If you want to register at easyMarkets, you first need to press the “Start Here” button at the top-right corner. There, you have to fill in the most basic details about your future account, such as your email, preferred password, and a phone number. Alternatively, you can also create an account by linking it to your Google or Facebook account, which is an additional advantage.

After creating a preliminary account, you can log into it and verify it. In order to do that, you’ll have to provide the exact details about yourself: your full name, birthdate, exact address, nationality, as well as your annual income, employment status, and other KYC-related information. Plus, you’ll also have to upload photocopies of your national ID and utility billing address.

The registration process has turned out to be pretty basic and simple – nothing too fancy to prevent you from signing up to easyMarkets.

Supported countries

Now, as we have already mentioned in the introduction of this review, easyMarkets is an international brokerage that provides its services to a bunch of different countries. With that being said, however, there are some nations that stay beyond the broker’s coverage.

Here are some of the unsupported countries we’ve found during our easyMarkets review:

- United States of America

- Israel

- Iran

- Syria

- Afghanistan

- North Korea

- Somalia

- Yemen

- and more…

In total, the list of unsupported countries includes around 25 different nations, which isn’t too bad considering that there are over 200 more countries in the world.

Which trading platforms can you choose at easyMarkets?

Another important segment to tackle in our review is going to be the platforms that facilitate trading at easyMarkets. We always give this section proper regard because if the software doesn’t keep up with complex trading features, it’ll quickly deteriorate the entire trading experience.

Fortunately, there’s no danger of deterioration with easyMarkets. During our review, we found two primary trading platforms that work for desktop and web platforms, as well as one mobile trading app for both iOS and Android smartphones.

MetaTrader 4:

- Tradable assets: 80+

- Order types: 8

- Technical indicators: 80+

- Automatic trading: Supported

- Copy-trading: Supported

- Desktop compatible: Yes

- Web compatible: No

- Mobile compatible: Yes

WebTrader:

- Tradable assets: All 200+ of them

- Order types: 8

- Technical indicators: 80+

- Automatic trading: Supported

- Copy-trading: Supported

- Desktop compatible: No

- Web compatible: Yes

- Mobile compatible: Yes

MetaTrader 4 in detail

MetaTrader 4 is one of the main trading platforms we found during our review of easyMarkets Forex broker. And the mere fact that it is available on the platform makes us even more certain that easyMarkets actually cares about a top-notch trading experience.

But it’s not just about the looks and the prestige of this software that we’re impressed by. The features that it comes with are really sophisticated and designed to give you the best chance of success.

Some of the best ones we have found are:

- One-click trading of CFDs

- Tighter spreads for all instruments

- Expert Advisors allowed

- Lots of pre-installed technical indicators

- Custom/predesigned trading templates

- 20 years of historical data to backtest

In short, you can never go wrong by choosing MetaTrader 4 as your main trading software.

WebTrader in detail

Unlike MT4, WebTrader is a proprietary platform developed by easyMarkets itself. And it comes with quite a few impressive tools that MetaTrader 4 doesn’t currently offer.

The first feature is called dealCancellation. It allows you to quickly correct your mistakes by undoing it for a very mall commission. So, if you make any mistake and it hasn’t been more than 60 minutes from creating an order, you can easily cancel the trade and bring the losses back.

Another feature found during our easyMarkets Forex broker review is the Inside Viewer. It’s basically like the traders’ sentiment feature that allows you to see what percentage of traders are buying and selling the security that you’re interested in. This way, you can make more accurate predictions about the upcoming price shift.

Last, but certainly not least, is the Freeze Rate feature. As easyMarkets itself puts it, you can use this feature to freeze any given market condition, i.e. the specific price that you really like, and place a trade exactly at that point, hence the word “Freeze.” On top of all that, easyMarkets’ WebTrader supports more financial instruments than MT4, which is also another advantage of this platform.

Mobile trading at easyMarkets

Besides desktop and web-based trading platforms, easyMarkets also allows its clients to trade on their mobile devices. And it’s not just any universal app that you can download and then modify for easyMarkets’ platform; it is proprietary software that the broker itself has designed and submitted to the App Store/Play Store. It comes with pretty much the same functionalities as its full-fledged counterparts, be it analytical tools, account monitoring, or deposits and withdrawals.

Which payment methods to use for easyMarkets deposits and withdrawals?

Next up, it’s time to move on to the next chapter of our easyMarkets broker review, which is the available payment methods for deposits and withdrawals. Sure, it is important to have a top-notch trading platform that effortlessly facilitates all traders’ positions, but if you don’t have proper payment methods, things will still fall apart, be it for security breaches, very slow payments, or large commissions.

With easyMarkets, you can be sure that there’s no such thing going on. The deposit/withdrawal methods are safe, not to mention their sheer number and accompanying features. But first, we have to talk about the minimum deposit requirement at easyMarkets.

As we have pointed out, the three live accounts at easyMarkets have very distinct deposit requirements:

- Standard account – $100

- Premium account – $2,000

- VIP account – $10,000

Therefore, the absolute minimum you need to deposit is $100. And as an entry threshold for a Forex broker, we think that it’s a very advantageous condition that a lot of traders will appreciate, regardless of their prior experience or current needs.

As for the actual deposit and withdrawal methods we came across during our easyMarkets review, here they are:

- Visa – Instant; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- MasterCard – Instant; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- Maestro – Instant; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- American Express – Instant; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- JCB – Instant; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- AstroPay – Instant; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- Sofort – Up to 24 hours; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- GiroPay – 2 hours; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- iDeal – Instant; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- Local Bank Transfer – 3-5 business days (up to 24 hours for Malaysia); No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- WebMoney – 1 business day; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- BPay – 1 business day; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- Neteller – Instant; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- Skrill – Instant; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- FasaPay – 1 business day; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- Local Deposit (Egypt) – Up to 7 days; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- SticPay – 1 business day; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- UnionPay – 1-2 business days; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

- WeChatPay – 1 business day; No maximum limitation; Withdrawals in 48 hours (sometimes 3-10 business days)

As you can see from this review of easyMarkets Forex broker, there is a huge number of payment methods for you to choose from. On top of that, none of these methods have commission charges whatsoever – you’re getting exactly the same as you’ve deposited/withdrawn.

Execution policy at easyMarkets

Moving on, let’s see what the execution policy at easyMarkets is and how quickly your trades will be placed here. This is no less important discussion point and can certainly say a lot about the professionalism of the given broker.

As we have discovered, easyMarkets’ primary execution type is market execution. What this means is that you’re placing trades at the exact same price levels as the market shows them. This guarantees two main things:

- You will place trades much more quickly;

- The spread for bid and ask prices will be much more shallow.

On top of that, easyMarkets doesn’t engage in requotes – a practice of betting against your own clients. This further increases the trustworthiness of the broker and ensures that your money is definitely kept in safe hands.

Besides the market order, our easyMarkets broker review has revealed a bunch of other order types that are also worth mentioning. For example, there are stop and limit orders that help you protect your trades from too greater damages; there are guaranteed stop losses for more guaranteed earnings. And finally, there’s the “no slippage” feature that allows you to execute trades without any price fluctuation between the moment you press the button and the moment a trade actually opens.

All in all, trade execution at easyMarkets is taken to a characteristically new level with the above-mentioned features and order types.

Get an education at easyMarkets’ learning section

Being an easyMarkets loyal customer means that you’re getting the best trading terms and conditions on the market. But it doesn’t just stop at that: the broker also provides a bunch of different educational materials to hone your skills and knowledge in trading.

During our review, we came across various educational materials, including informative articles, tutorial videos and online books, trading courses, and many more. With the motto of “Explore, Learn, Grow,” here are these educational materials in detail:

easyMarkets Academy

The first educational segment to discuss here is the Trading Acadamy. As our easyMarkets Forex broker review shows, this section is completely free of charge and is accessible for all easyMarkets clients.

The easyMarkets Academy covers a bunch of different topics:

- Introduction to Financial Trading

- Technical Analysis

- Fundamental Analysis

- Trading Psychology

- Risk Management

and a bunch of other important aspects of trading. What’s more, you can also check your knowledge with interactive tests at the end of each module. In short, the Trading Academy at easyMarkets can really take your trading game to the next level.

Free Ebooks

Next up, there are around 10 different ebooks that take you through different aspects of online trading. It is separated into four categories:

- Market Trading – 4 ebooks

- MT4 Guides – 2 ebooks

- Options – 2 ebooks

- Mobile Apps – 1 ebook

Knowledge Base

Knowledge Base is a section that contains lots of different articles about financial trading. It categorizes into six different sections and each of these sections has way over 10 articles. These sections are:

- Discover Trading

- Start Trading

- Get to know easyMarkets

- Understanding Analysis

- Get to know MT4

- Mastering Self

One thing that we have discovered about these articles is that they are written very professionally – the structure is great, the content is easily understandable, and all of the articles are jam-packed with information.

Economic Indicators

This next section found during our easyMarkets review lists all of the major economic indicators and explains their importance in trading. This list includes High, Medium, and Low impact indicators that you can use for fundamental analysis.

Trading Glossary

Finally, there’s a huge glossary section that explains all of the possible terms and phrases that you may come across in financial trading. These simple definitions of trading vocabulary include everything from American Option and Arbitrage all the way to Z-Certificate and Zero Coupon Bond. Plus, all of these terms are categorized in alphabetical order, making it easy to actually find them in this huge list.

Conducting research at easyMarkets

This penultimate section of our review will cover every available research tool that you can get with easyMarkets. The broker’s website features a pretty extensive Market Analysis section that comprises of different research tools and methods.

Among these features, the most notable ones are interactive trading charts, trusted news reports, dealCancellation, and many more. Let’s dive deeper and check out each of them more closely.

Market News

When it comes to trading Forex, or just about any financial instrument, it is virtually a no-brainer to always be in touch with recent economic developments. And as shown in our review of easyMarkets Forex broker, the market news are covered pretty extensively. As the broker itself points it out, a person who is serious about trading should know what effects macroeconomic data, geopolitical events, and other significant developments have on asset prices.

Trading Charts

The real-time instrument charts from easyMarkets allow you to observe your preferred financial asset as they move forward. One of the many best things about this feature is that it is accessible for everyone, regardless of whether they’re the members of the easyMarkets community or not. And, what’s more, you can interact with these charts exactly the same way you would with the charts in full-fledged trading software: search and select any financial asset, choose the chart type, insert different technical indicators, and even compare multiple instruments.

Trading Signals

Yet another useful research segment offered by easyMarkets is called Trading Central trading ideas. Trading Central is a prestigious research center that provides useful signals to traders and investors. These signals help people get a better grasp of ongoing market developments and be more productive on the market, which is always an advantage of any given platform.

Technical Indicators

Another important research segment found during our easyMarkets broker review is technical indicators. These are incorporated within trades to conduct technical analysis and try to predict future price movements as closely as possible. With easyMarkets, you’re getting more than 80 different indicators.

Exclusive Features

Besides the above-mentioned popular features, easyMarkets goes way beyond the market average by offering its own trading tools. One of the most notable features is called dealCancellation. It gives you much better control over your trades, allowing you to close a position within the first 60 minutes and get the lost money back for an insignificant fee.

Another useful feature is called Freeze Rate. When you start trading on virtually any market, you should always expect to get very rapid changes in asset prices. In fact, these changes are so quick that from the moment you press the button to when it actually opens, the price can change significantly and go against your original position. With the Freeze Rate, you can have the market ‘frozen’ on one specific price and be sure that it’ll stay the same until you place a new position.

Customer support at easyMarkets

In this final chapter of our easyMarkets Forex broker review, we’ll have a look at the broker’s customer support department and see, how easy it is to communicate with it. Just like with all other features and offerings, we weren’t disappointed by the Contact Us page we found on Easymarkets.com.

This section includes:

- International support: Ajeltake Road, Trust Company Complex, MH 96960, Ajeltake Island, Majuro, Marshall Islands

- Email support: [email protected]

- Live chat on the website

- Social media support

Email support

The email support is the primary interaction mechanism at easyMarkets. It facilitates official communication between the broker and its clients and makes sure that it is as helpful as possible. And despite the fact that it’s not the fastest way to contact the broker, easyMarkets’ email support still manages to be an outstanding communication channel on this platform.

Live chat

Live chat is one of the most popular ways of contacting the support team for the majority of brokers. And easyMarkets is no exception in this sense. This communication allows for faster responses that are still very thorough and helpful.

Social Media support

In addition to the more traditional support methods, there are also various social media platforms that can be used just as successfully. Our easyMarkets review shows three different social media messengers:

- Facebook Messenger

- Viber

- What’s App

These are pretty much the same as the live chat we talked about above: the responses are almost instantaneous and they’re always helpful.

The ultimate verdict

As our review has successfully demonstrated, easyMarkets is one of the most trustworthy Forex brokers on the market. Whether it’s for the broker’s license, trading terms and conditions, or various research or educational materials, easyMarkets definitely stands out among its immediate competitors.

The first aspect we reviewed was the broker’s license. And as expected, easyMarkets features not one, but two financial licenses from Cyprus and Australia. These regulatory materials ensure that when you make a deposit on this platform, you’re as safe as it can get.

Then we moved to the instruments that you can trade with easyMarkets, as well as various terms and conditions that come with them. As we have found out, there are six different asset classes available on this platform, and they’re accompanied by some of the most impressive numbers.

As for the trading platform, as well as the payment methods, we weren’t disappointed by the discovery of MT4/WebTrader and a bunch of different financial methods during our review of easyMarkets Forex broker. It further proved that we’re dealing with a top-tier trading brokerage.

Ultimately, this review was enough to prove the credibility of easyMarkets. Therefore, we can safely recommend it to any of our readers.

Frequently Asked Questions

Is easyMarkets a scam?

Most certainly not! The broker has been operating on the market for almost 20 years now, and during that time, it has garnered a lot of fame and acclaim. Currently, easyMarkets features 37 international awards, which is one main proof that this is a credible broker to trade with.

But there’s more proof of it: easyMarkets has two of the strictest financial licenses in the industry:

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities and Investments Commission (ASIC)

What these licenses ensure is that your money is protected with some of the most sophisticated fund protection mechanisms, be it negative balance protection, account segregation, etc. Therefore, it’s pretty safe to say that easyMarkets is far from a scam.

Which accounts can I open at easyMarkets?

When signing up at easyMarkets, you get the chance to register for three retail accounts:

- Standard – $100 min. deposit

- Premium – $2,000 min. deposit

- VIP – $10,000 min. deposit

These accounts are significantly different from one another, yet they also have some inherent similarities, such as the maximum leverage of 1:400/1:200, no commissions, and low spreads.

Besides these accounts, our easyMarkets broker review has also revealed Islamic and demo accounts. With an Islamic account, you can eliminate all interest rate charges for overnight trades, whereas a demo account allows you to unlock your full potential by trading virtually.

How high are the easyMarkets’ commission levels?

Besides some of the most impressive trading offerings, it’s worth noting that the conditions for using easyMarkets’ platform are also very beneficial. That includes various commissions as well. As we have discovered, there are no commissions for maintaining your account or trading specific instruments. The only viable commission charge is through spreads, and it’s also worth noting that spreads at easyMarkets are pretty shallow, going as low as 0.9 pips.

As for other non-trading fees, easyMarkets definitely sets itself apart by eliminating almost all unnecessary charges. That includes deposit and withdrawal fees, inactivity fees, etc.

How can I contact easyMarkets’ support team?

There are four main ways to communicate with the broker’s support team. These methods are:

- International support: Ajeltake Road, Trust Company Complex, MH 96960, Ajeltake Island, Majuro, Marshall Islands

- Email support: [email protected]

- Live chat on the website

- Social media support

The fastest way to contact easyMarkets is definitely via live chat or social media messengers. Yet if you want a more personalized interaction, you should probably go for an email support, or even the international support with face-to-face interaction.